In baseball, don’t take the field to defend when you’re still at bat. Current defensive rotations defy technical and fundamental data.

This analysis provides bonus insights to extend the Yahoo! Finance video with Mark Newton and Brian Barnier.

Mark Newton – Chief Technical analyst/Managing Member, Newton Advisors, LLC:

The rotation towards defensive leadership this year has been nothing short of astounding. After nearly five months of trading for 2016, with equities within striking distance of all-time highs, we see steady outperformance by Utilities, Telecom and Consumer Staples, ranked 1, 3 and 5 in this year’s Top performing sectors (of the ten SPX Global Industry Classification System (GICS) Level 1 Sectors). Defensive sectors like Consumer Staples that includes the Food/Beverage/Tobacco group along with subsectors like Household Products and Staples/Retailing, have outperformed the Consumer Discretionary sector by more than 350 basis points thus far over the first 20 weeks of trading.

What makes this remarkable is that equity indices really haven’t shown much evidence of any real deterioration. When looking at the performance of DJIA, SPX and NASDAQ, all of these are trading within 1.5% of where they began the year, with SPX less than 3.7% away from all-time highs made almost exactly one year ago.

Brian Barnier — Economic and fundamental analyst/Principal, ValueBridge Advisors (U.S.) & Head of Research, BurntOak Capital (U.K.):

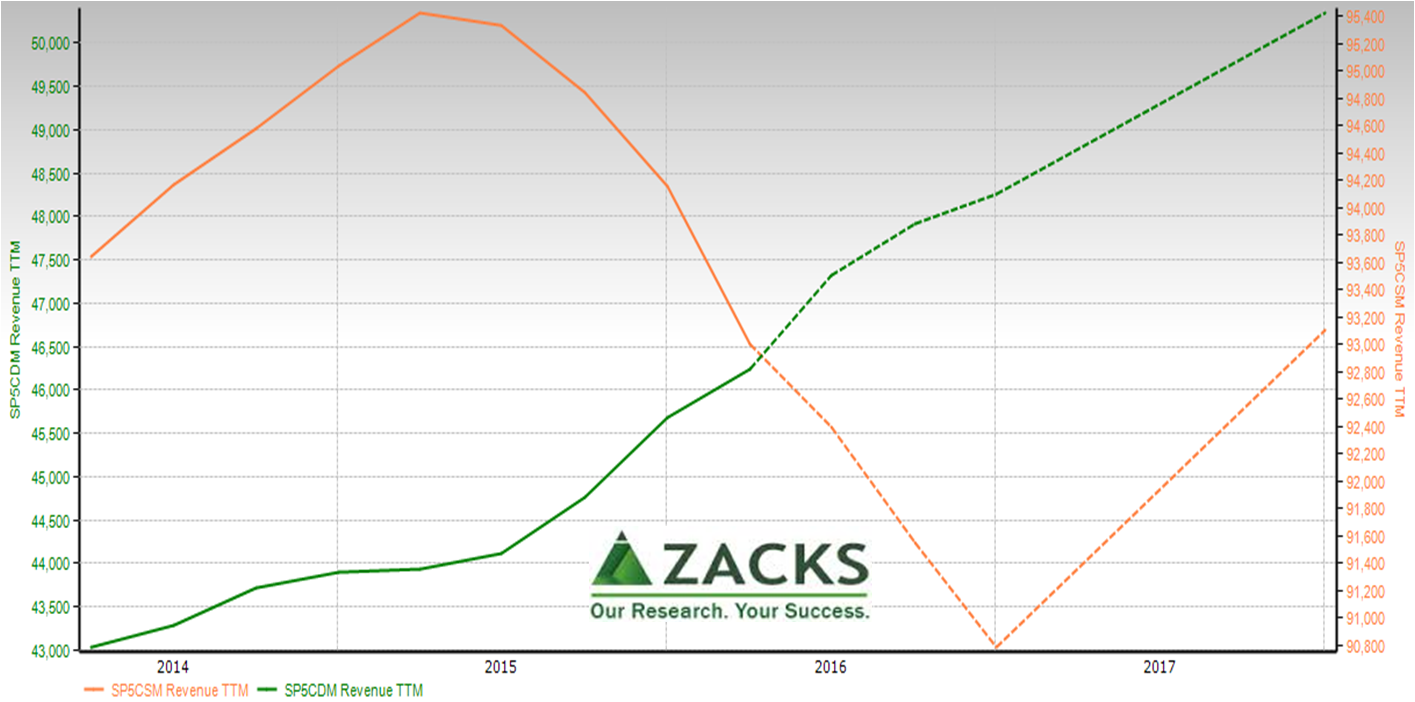

Fundamentals agree. During 1Q2106 earnings season, fear focused on the drop in S&P500 member revenue, as shown previously. Looking at revenue trailing twelve months for the S&P 500 Consumer Discretionary (green line) and Staples (orange) sectors, Discretionary clearly has the growth for both the past year and estimates for 2016 per Zacks consensus analyst survey.

Note: For Zacks Research System users, this chart is created with the Interactive Chart module, selecting Company/Composite, then S&P Composite Proxies, then select Fundamentals for Revenue Trailing Twelve Months (TTM) and EBIT TTM (chart below).

Note: For Zacks Research System users, this chart is created with the Interactive Chart module, selecting Company/Composite, then S&P Composite Proxies, then select Fundamentals for Revenue Trailing Twelve Months (TTM) and EBIT TTM (chart below).

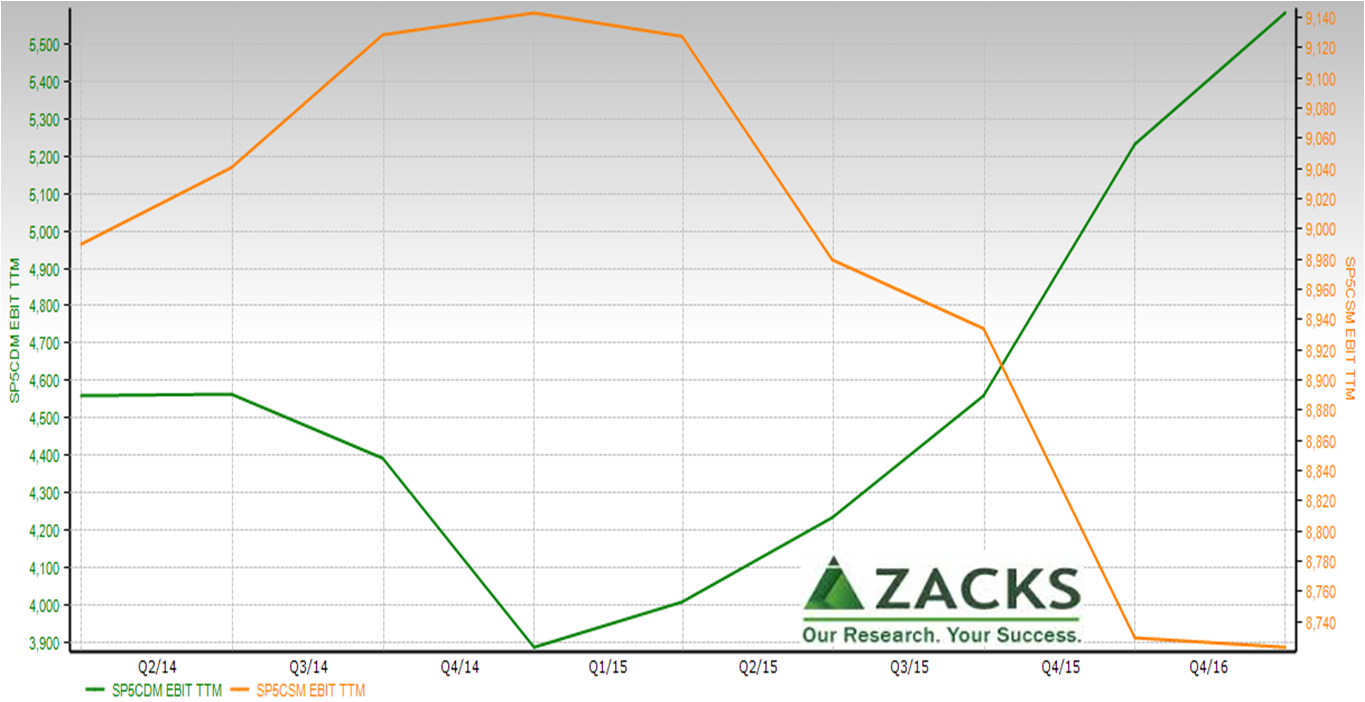

From an EBIT perspective, the recent performance trend also favors Discretionary.

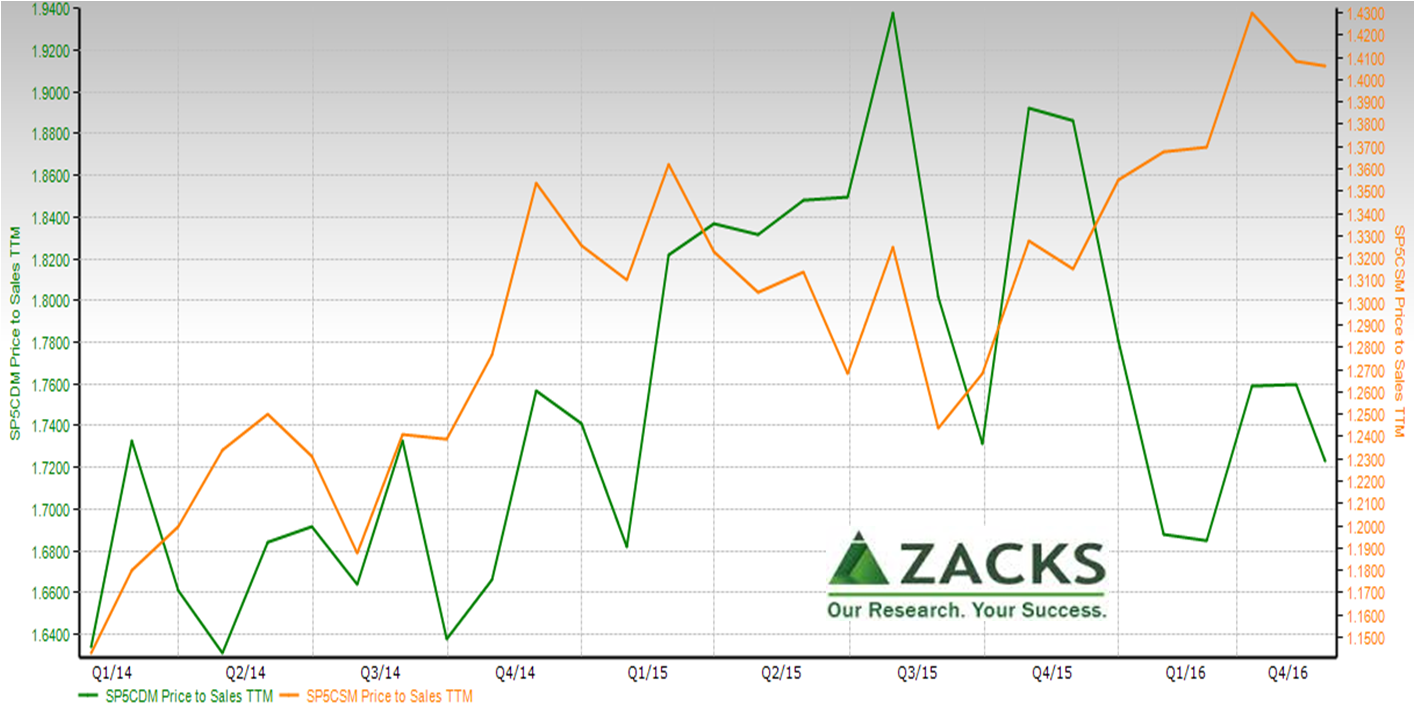

Putting price in the picture with sensitive sales, shows Discretionary undervalued relative to Staples.

Putting price in the picture with sensitive sales, shows Discretionary undervalued relative to Staples.

Note: For Zacks Research System users, follow same path as two prior charts, but in last step, select Valuation measures.

Note: For Zacks Research System users, follow same path as two prior charts, but in last step, select Valuation measures.

Of course, technicians have different tools for seeing turns than fundamental analysts.

Mark Newton:

Two key charts in the video and Yahoo! Finance blog show this “risk-off” trend regardless of indices holding up in resilient fashion:

- Consumer Staples, which recently moved to new all-time high territory for 2016 in early April, mirrored the movement seen in the defensive Utilities group. While concerns about valuation in Staples might be a reason to consider selling from a fundamental standpoint by some, technically, this remains a compelling sector to favor for outperformance given the ongoing strength and momentum, and lack of any real damage.

- The Consumer Discretionary sector RELATIVE to Consumer Staples, when viewed on a ratio basis, managed to break down from a seven-year uptrend in outperformance for Discretionary, which began at the beginning of 2009 when the market bottomed in March of that year. This break certainly seems to suggest a shift in the secular sector rotation which has guided stocks higher since that time. Given that the overall equity trend moved from bullish to more neutral in mid-2014, when Small-caps began to show signs of underperformance, this relative weakening in Discretionary goes “hand in hand” with this shift, despite the broader markets really not giving much evidence of technical damage.

The technical key takeaway is that often the long-term shifts in sector rotation can be eye-opening. Yet, this is often a better guide to positioning in the equity market than what might be discerned from benchmark indices alone. The drop in Discretionary versus Staples directly seemed to correlate with Small-cap weakness in US Equities in mid-2014 that led to a severe slowdown in price appreciation that led to a slowdown in breadth and momentum at a time when broader popular index (DJIA, SPX) gauges really showed no such thing.

Brian Barnier:

Of course, there are macro clouds of concern as described in the Yahoo! Finance video and blog.