Weaker labor productivity isn’t widespread or always bad. The more central bankers are guided by productivity, the more investors need to understand what’s really happening.

“Why is productivity growth so poor?” is widely asked. Here’s the catch… the question assumes a problem. In the data, neither labor productivity nor multifactor productivity is widely weak.

So where did this squishy assumption come from? From the aggregate average measures that make news headlines. An example is “Nonfarm business sector productivity.” Yet, the “nonfarm” in the name is the first clue to a problem. A long time ago in a farm field far, far away, statisticians realized that labor productivity (the ratio of output to labor hours worked) on farms was different from other industries.

Failure to appreciate differences across all industries is mostly why people puzzle over poor productivity growth.

Latest data

On May 17th, the U.S. Bureau of Labor Statistics updated industry productivity data for 2017. Most industries other than those in the wholesale and retail sectors are included.

The data again tell the story of how industries vary widely compared to each other and over time.

Highly dynamic

In “Investors, labor productivity is not widely weak; business models matter more,” bar charts show differences in productivity growth by industry and a line chart shows examples of fluctuations within industries over time.

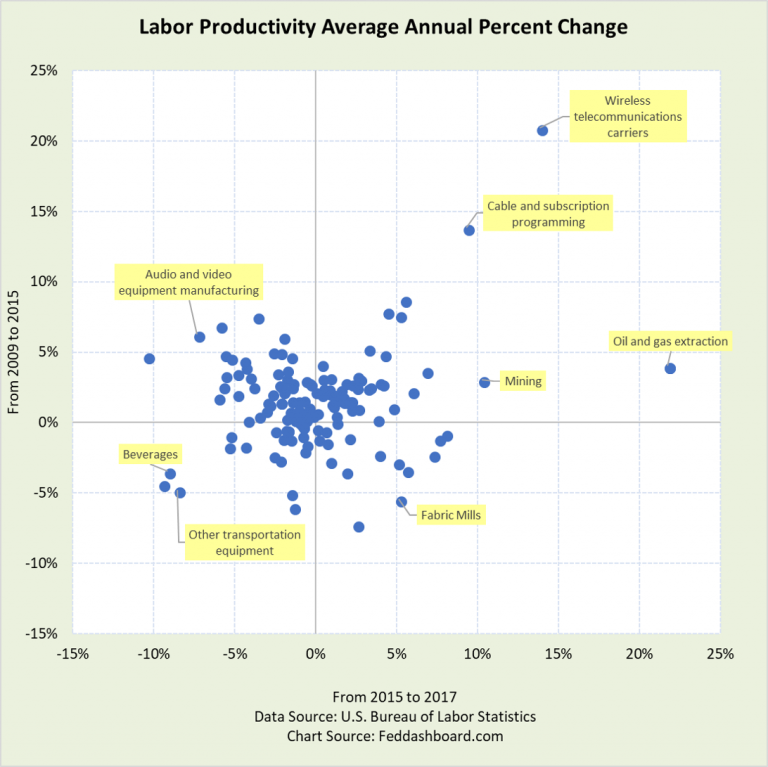

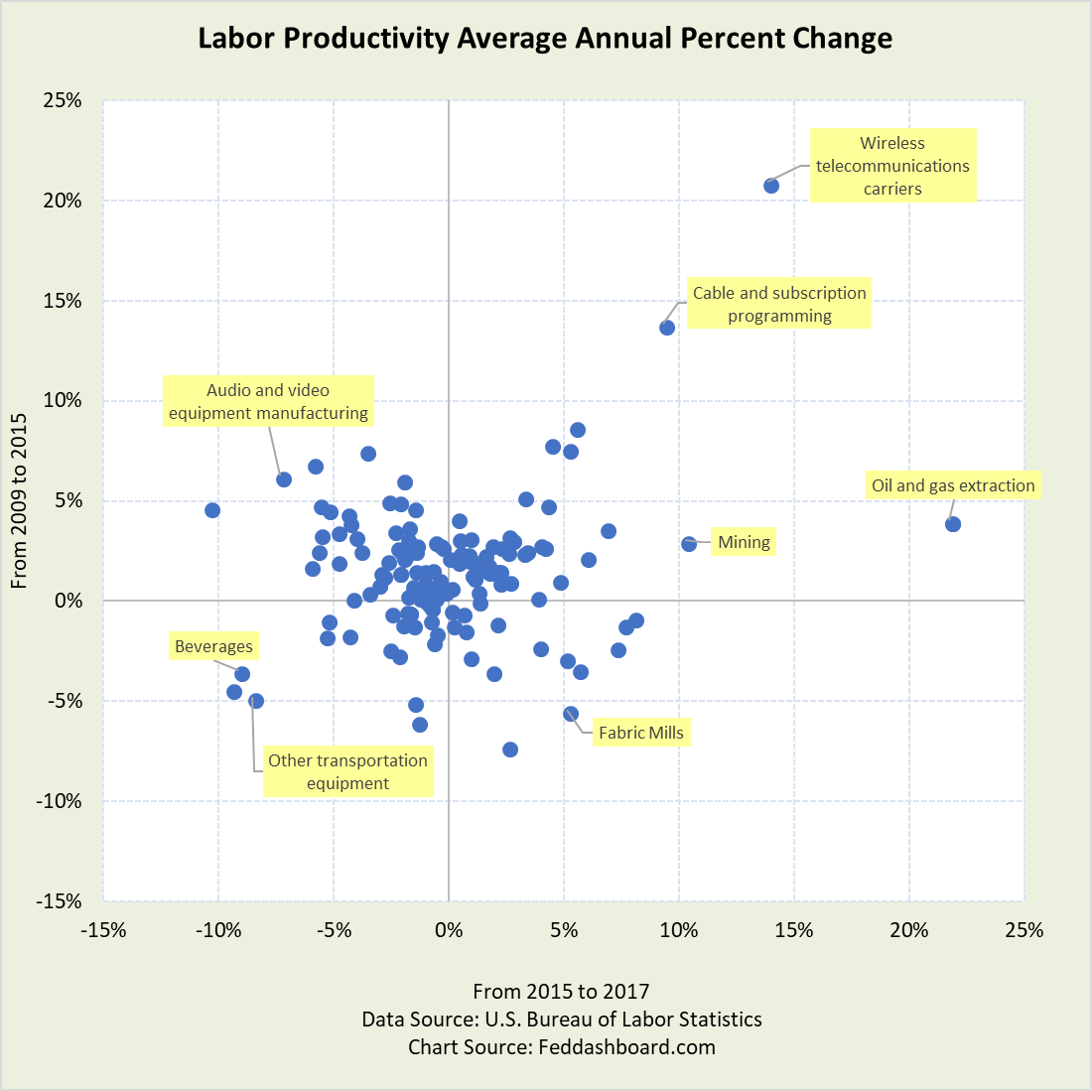

Below are two simplified views that aspire to illustrate those differences. Both views:

- Compare average annual percent change from 2009 to 2015 with 2015 to 2017. In financial market trader-speak, they are a bit like momentum gauges.

- Reveal dramatic changes that are hidden in the “headline” aggregate averages.

In the scatter plot, 2009 to 2015 annual percent change is on the vertical axis and 2015 to 2017 annual percent change is on the horizontal. Any point on a 45-degree line means no change in growth rate in the more recent period. A shift to the right means productivity growth improved in the more recent period, such as for Oil and gas extraction. By contrast, Wireless communications carriers slowed productivity growth.

Again, differences by industry and time – “headline” aggregate averages hide implications for workers, investors, and policy-makers.

The scatter plot highlights industries on the edges.

The scatter plot highlights industries on the edges.

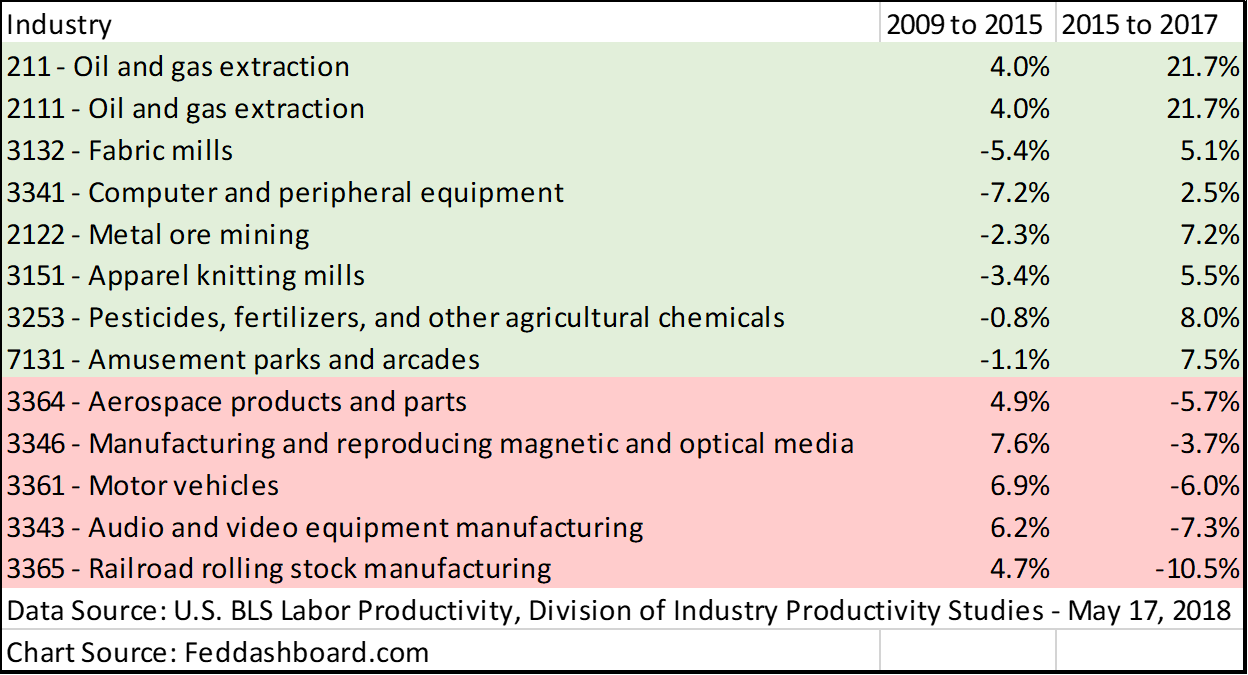

The table below highlights industries with the most acceleration or deceleration.

As you read each industry name, consider what you know about it from reading investment analysis of the industry and the companies within it. Each one has a story about how labor hours are shifting in location (onshore or offshore), job type, worker skill levels, management methods, business environment, technology, equipment, structures, energy, and outsourcing.

For the fascinating pattern of the Oil and gas extraction industry, see “Another theory goes “poof” – labor doesn’t limit growth like it used to.”

For the fascinating pattern of the Oil and gas extraction industry, see “Another theory goes “poof” – labor doesn’t limit growth like it used to.”

Business priorities – productivity is not top of the list

Recall:

- These productivity estimates don’t necessarily measure productivity as a business would

- Lower labor productivity isn’t necessarily bad because it could be caused by a business maximizing financial returns, especially on expensive assets

- In global value chains, shifting labor into the U.S. has a tendency to lower U.S. labor productivity. Measuring productivity is further complicated when it is difficult to measure the outputs in each country.

- Transitions such as building capacity in oil fields can hurt measured labor productivity

Implications

- For investors, consider productivity in view of your companies and their industry. Yet, realize that company focus is more on financial return measures that affect your dividends and share price appreciation.

- For central bankers, headline measures hide answers, so reduce the influence of productivity on monetary policy. Instead, rising in importance are financial market flows, trade flows, and foreign exchange rates.

To learn more about how to apply these insights to your professional portfolio, business or policy initiative, contact “editor” at this URL.

Data Geek note: definitions of production workers at https://www.bls.gov/web/empsit/cestn.htm#section1