Improving technology and management technique means that our economic growth isn’t as limited by labor as it once was. Policy-makers need to shift their focus from labor productivity to measures that matter more to business investment decisions.

“Labor force and labor productivity growth are the only way to get economic growth” is a frequent refrain in economic policy circles. But, that’s not as true as it once was.

The theory came together way back when automobiles looked like this — 1928 Ford Model A.

Photo credit: Ford Motor Company and The Henry Ford

In 1928, automobile manufacturing was like this video taken at a Ford Motor Company factory https://www.youtube.com/watch?v=JkCJkdcl8mw.

Yet Henry Ford and others who recognized the impact of McCormick’s reaper on agriculture applied innovative technology to their industries and thus disrupted theory as fast as the ink was drying on the academic papers.

For those curious to learn more about Ford Motor Company’s innovation in management technique and technology – especially little known and historically pivotal stories — see The Ford Men: From Inspiration to Enterprise, by R. Christopher Whalen.

The global tech transformation marches on

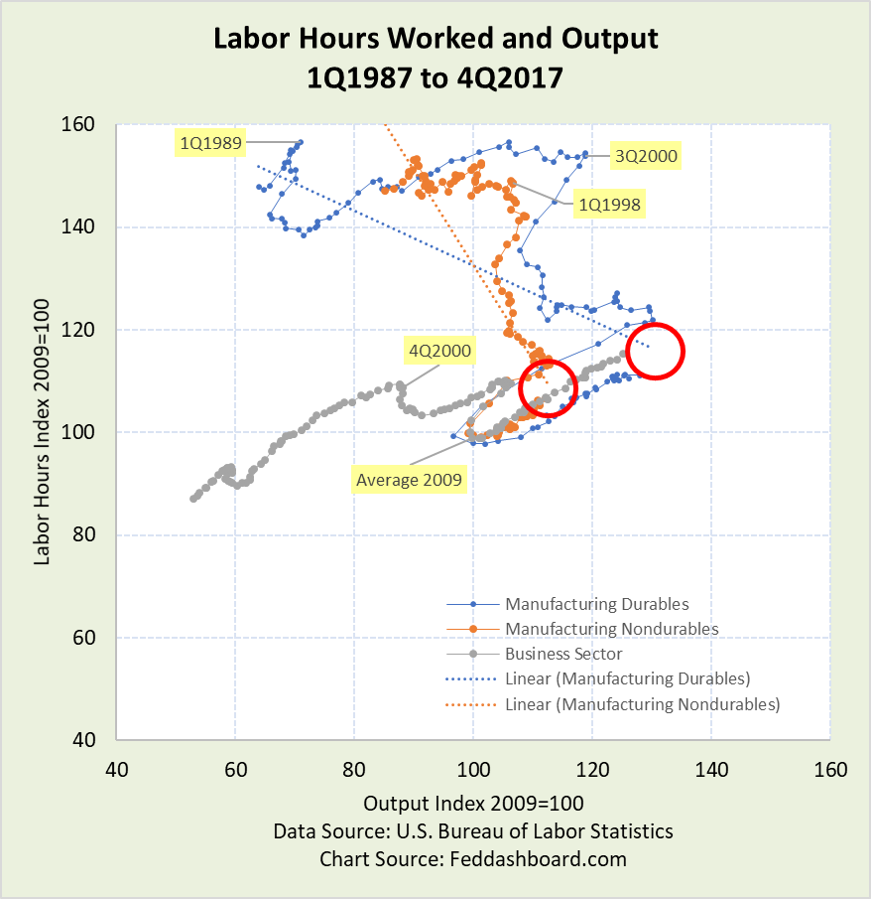

The scatter plot below shows that the theoretical relationship between labor hours worked and output still holds in the overall Business Sector – especially as economic activity has shifted toward service industries, particularly the growing hospitality industry.

But elsewhere, the role of labor has diminished. In the durable and nondurable manufacturing sectors, the trend has been more output with fewer labor hours as management technique and technology improved.

After a big cut to hours and output in 2009, both sectors started recovering toward their thirty-year trend. The red circles surround the current end of the trend line and are close to current values.

- Importantly, this means that weak growth in labor productivity is not a mystery. Rather, one explanation in the data is a recovery of labor hours to trend after draconian cuts in 2008-9. For more reasons, see our Productivity Section https://feddashboard.com/category/productivity

- Labor hours worked in the durables sector have been stagnant since the end of 2014. While good for productivity, fewer hours are bad for workers. This raises the question; will durables continue sideways as in the late 1990s and 2003-7? The answer will be influenced by tax and trade policy in Washington.

Automobile assembly has increasingly adopted robots as seen in this video from BMW’s Spartanburg factory https://www.youtube.com/watch?v=VpwkT2zV9H0 .

Automobile assembly has increasingly adopted robots as seen in this video from BMW’s Spartanburg factory https://www.youtube.com/watch?v=VpwkT2zV9H0 .

Improved technology and management technique mean that less labor is needed to produce the same or even more output.

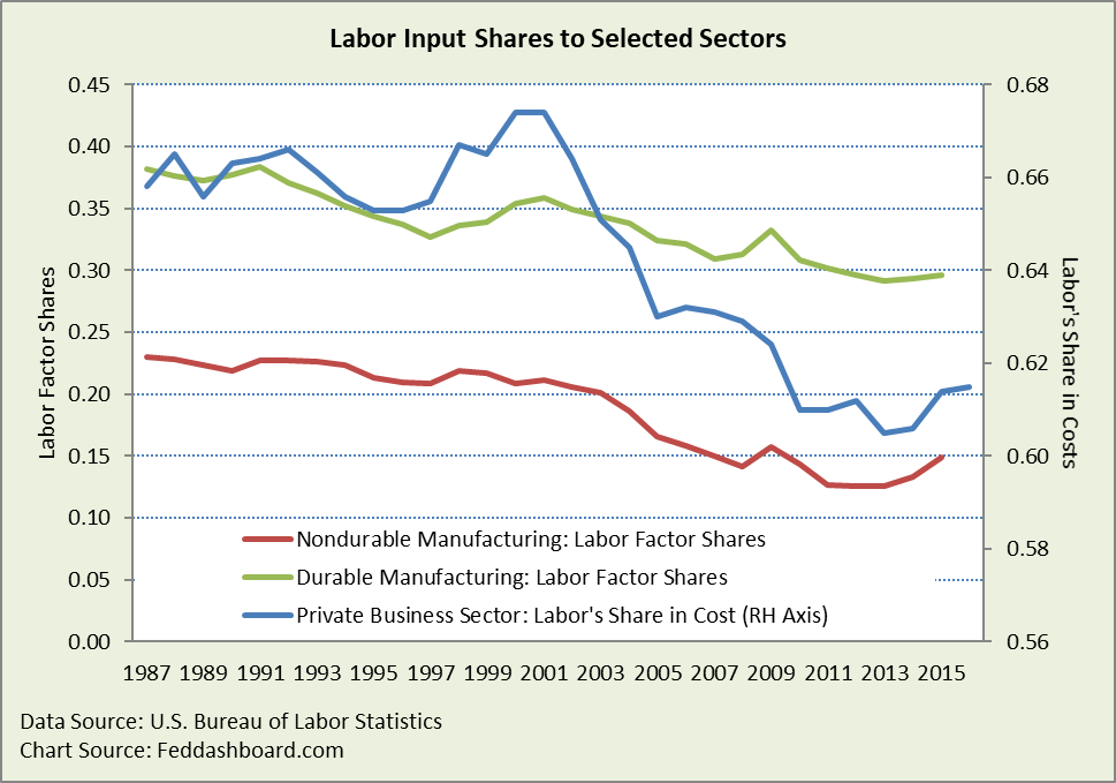

Labor’s Share in Cost for Private Business Sector varied between about .65 and .68 since 1948. Starting in 2001 – coinciding with the broader economic contraction – it dropped below its historical range.

Labor’s Share in Cost for Private Business Sector varied between about .65 and .68 since 1948. Starting in 2001 – coinciding with the broader economic contraction – it dropped below its historical range.

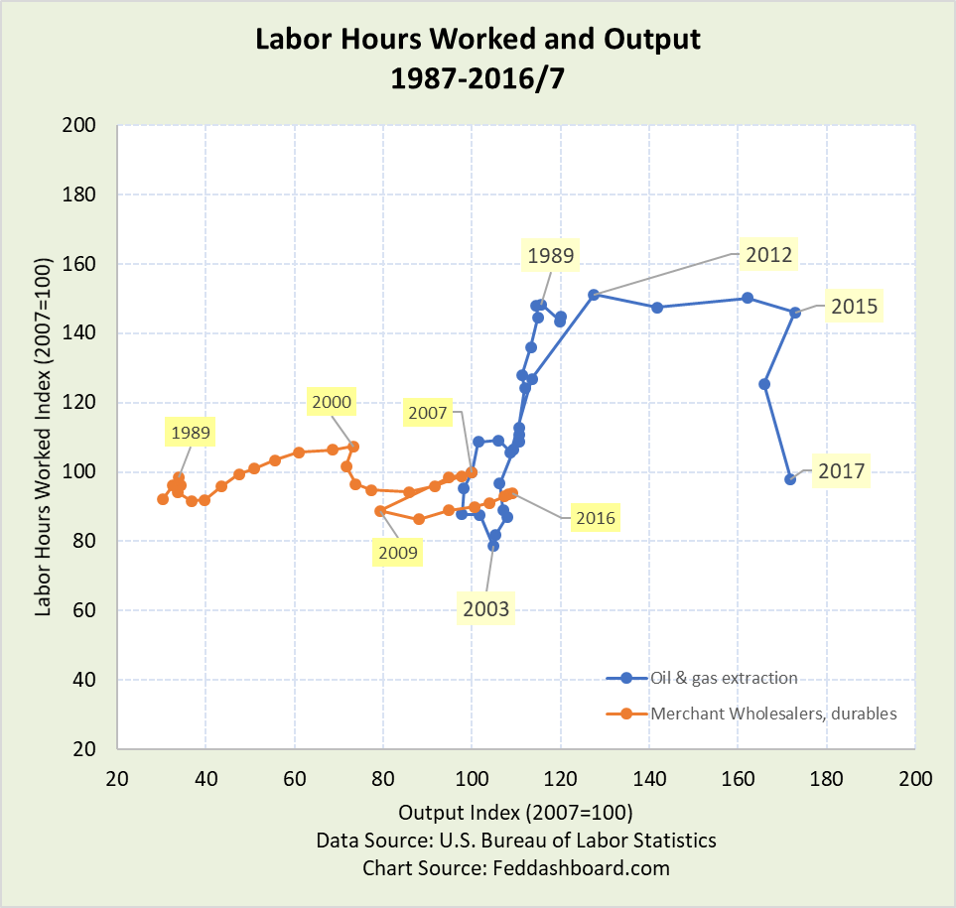

Scatter plots reveal dynamics in any industry:

- In oil and gas, labor hours dropped like a rock after 1989, then exploded in 2010 to build new fields with new technology, then stopped as fields went into production

- In contrast, merchant wholesalers of durables saw waves of labor hours growth reflecting consumer spending. Yet, output grew faster than labor hours. The wholesale trade overall (not shown) has less fluctuation in labor hours (a flatter line).

For the hospitality industry, here come the robot bartenders https://www.youtube.com/watch?v=VuacxPWkegU.

For the hospitality industry, here come the robot bartenders https://www.youtube.com/watch?v=VuacxPWkegU.

Importantly, the point is not just industry differences in labor productivity. It’s bigger.

- Innovation in automation and management has been enabling business model change

- Industries are being continually reshaped. It’s not just about the future; it is about powerful trends long underway, as we showed in “Your job’s future in three charts.”

- Aggregate averages hide details by industry, company, and job type that matter to policy decisions.

Bottom line

- Data show labor hours can fall as output grows. Improved management and automation enables production with fewer people

- Falling need for labor inputs means that labor force and labor productivity growth are not the constraints on production growth they once were. Previously, we also showed how “Potential GDP is potentially misleading.”

For more, see Labor productivity gets trumped by ROI, part 2 of 3 in this series.

To learn more about how to apply these insights to your professional portfolio, business or policy initiative, contact “editor” at this URL.

Data Geek Notes:

- Cobb, C. W.; Douglas, P. H. (1928). “A Theory of Production”. American Economic Review. 18 (Supplement): 139–165. Cobb and Douglas mentioned both labor and physical capital. However, policy-makers frequently focus primarily on labor, overlooking the magnitude of management technique and technology.

- For antique auto buffs, see https://commons.wikimedia.org/wiki/Category:1928_automobiles

- Nondurable goods include: food, beverage, tobacco, textile, apparel, leather, paper, printing, petroleum and coal, chemicals, and plastics

- Durable goods include: wood, nonmetallic mineral and metal products, machinery, electronic and electrical products, appliances, transportation equipment, and furniture