Company quarterly results are misleading investors because the reference point has changed. For today’s dynamics, investors should ask sharper questions about sales, product cost structure, capex and risk.

Company results need to be recalibrated by investors to adjust for shifts in trends including economics, technology, global trade and value chains. Yet, most companies don’t publish the needed data. So, investors must ask – starting with these five questions:

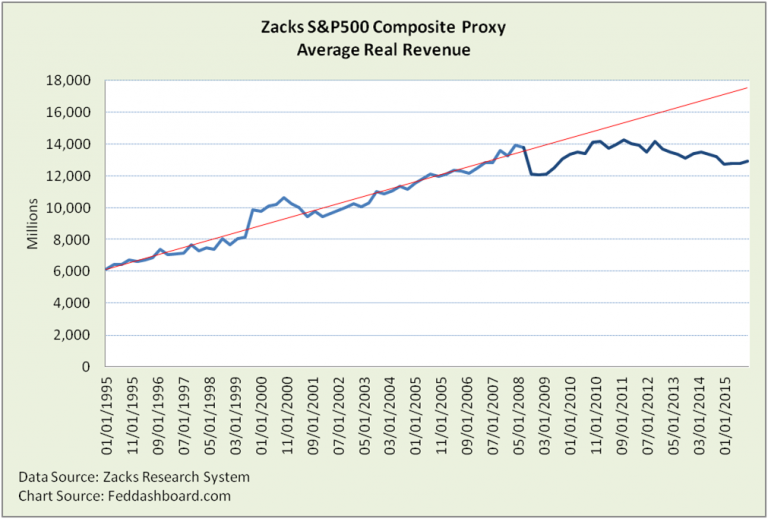

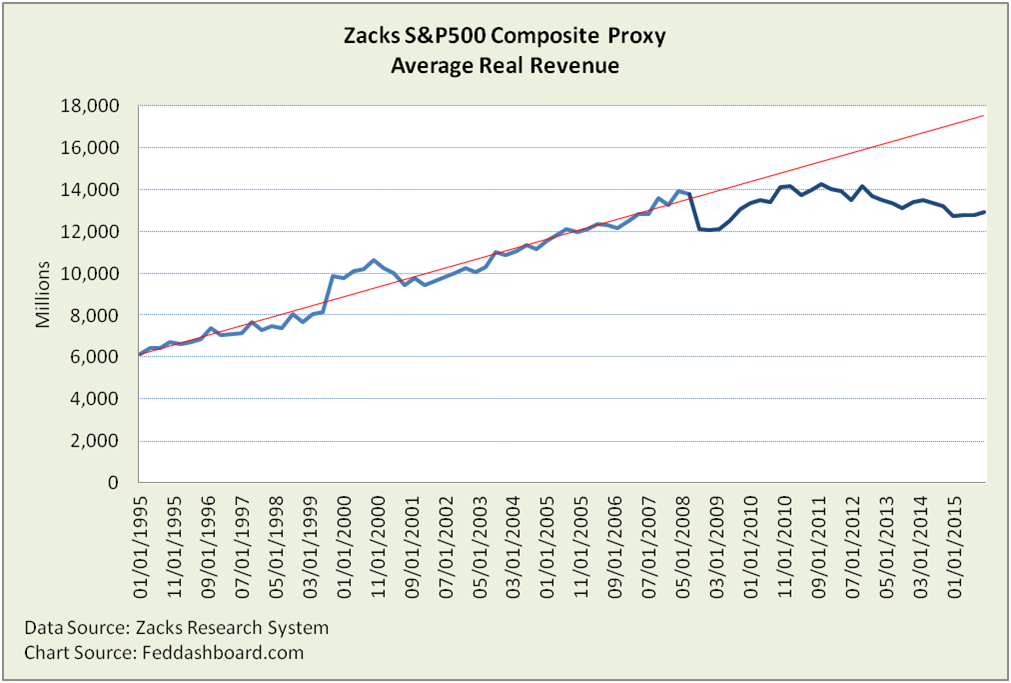

1. How many units were sold and where? Look at a big picture, the sales gap from the pre-2008 trend is frightening to institutional and individual investors, down by over 25%.

Recall, if S&P 500 members were a country; they would be the second largest in the world. Revenue is the corporate equivalent of country GDP (other than inventory adjustment), thus the S&P 500 has mostly been in recession. But, sales growth by member varies widely. As we illustrated a year ago, about a third of CEOs were captains of “sales submarines” with sales declines – today, it’s jumped to half. Why? Some companies are facing true external shocks. Many more seem unable to adjust their business model to today’s dynamics. To understand how much of the cause lies in business model, two contributors need to be filtered out.

Recall, if S&P 500 members were a country; they would be the second largest in the world. Revenue is the corporate equivalent of country GDP (other than inventory adjustment), thus the S&P 500 has mostly been in recession. But, sales growth by member varies widely. As we illustrated a year ago, about a third of CEOs were captains of “sales submarines” with sales declines – today, it’s jumped to half. Why? Some companies are facing true external shocks. Many more seem unable to adjust their business model to today’s dynamics. To understand how much of the cause lies in business model, two contributors need to be filtered out.

One is the recently stronger U.S. dollar. But, as we wrote previously quoting S&P 500® 2014 Global Sales Report, more than half of companies don’t report international sales, so investors must ask.

Another is tech and trade-driven falling product prices. As we showed in the past, the average of all goods prices turned flat in the mid 1990s, led by technology products falling on exponential decay curves. Thus investors need to ask for units shipped, as is already reported by some consumer electronics companies.

2. How has product cost changed? In analyzing falling prices, a question is whether lower prices are due to falling demand or falling product costs. With retail prices of globally tradable goods falling for two decades, it’s more rooted in costs.

To understand changes in business model, investors need to ask: 1) How per unit costs have changed versus fixed costs, 2) how fixed costs have morphed into variable costs through outsourcing and related arrangements, and 3) which elements in the value chain – from research-to-retail – have dropped most and why. This last element is especially important as traditional accounting emphasizes production cost, rather than research-to-retail costs with strategic implications for the value chain.

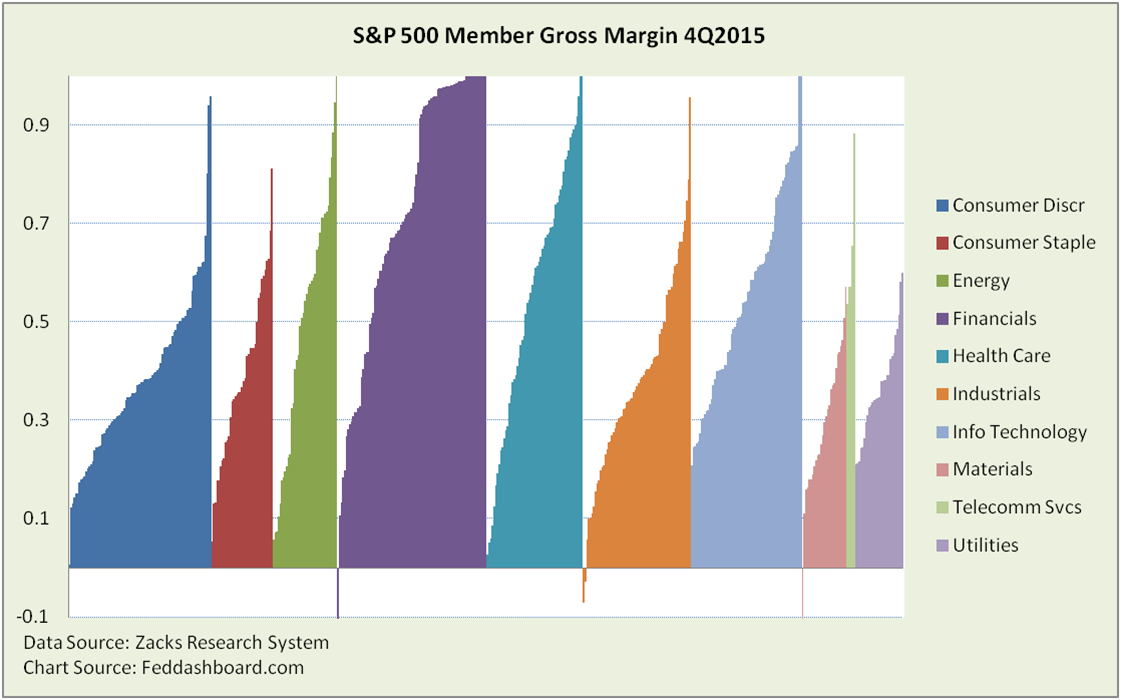

Gross margin by industry sector data makes business model-based investors especially eager for more product cost insight. Why?

- Looking at time trends, companies began managing gross margins more tightly after 2001 and especially after 2009. So the opportunity is to buy companies where this management reflects a thoughtful business model. Then, sell the companies cutting into competitive differentiation, product development and quality.

- Looking at the “flag chart” (below) of individual companies grouped by industry sector, large differences mean opportunities to buy companies with better business models for innovating across research, new products, production and sales.

3. Exactly how is Property, Plant and Equipment (PPE, a.k.a. capital expenditures) being used?

3. Exactly how is Property, Plant and Equipment (PPE, a.k.a. capital expenditures) being used?

- How much PPE is used to: maintain capacity versus expand capacity versus create capacity for new products?

- What type of equipment was acquired? Some equipment (especially globally-purchased and technology-based) isn’t as pricey as old models; enabling a business to do more with less (just think about your own computing devices).

- Is PPE being shifting from an investment to an outsourcing expense?

- How does type of equipment acquired affect physical plant space needed? This is important as companies shift to smaller footprint operations. Also, as we noted before, the drop in structures is one of the reasons measured labor productivity appears lower.

4. What risks are reflected in the discount rate? In calculating price targets, the toughest number to estimate is the discount rate. As we wrote previously, monetary policy has up-ended typical approaches to risk premia. This makes separating macro, industry and company risk increasingly complicated. When analysts guess, companies are often frustrated. So, fix it. Companies, state the company-specific risk included in discount rate. Analysts, ask for it.

5. Are announcements in advance of earnings helpful or distracting? Longer term investors are sympathetic to companies being churned by traders. Thus, new product or strategic announcements just before a quarterly release are understood. However, share buy-back (as discussed previously) or tactical announcements should be a flag to dig deeper into releases to find weaknesses.

Investors and analysts are flying blind if they don’t ask the right questions. Companies not publishing the right data miss opportunities to connect with coveted longer-term investors. Make a difference – speak up.

Data geek note

Zack’s S&P composites are calculated based on today’s members rather than with members from each historical period. This provides an apples-to-apples comparison (aside from acquisitions or divestitures with members outside an index).