“Retire at 30 with 30 stocks” sounds so appealing, but is it true? Of course, it depends on factors used, rebalancing period and macro. The 4Rs go a long way to finding the right factors.

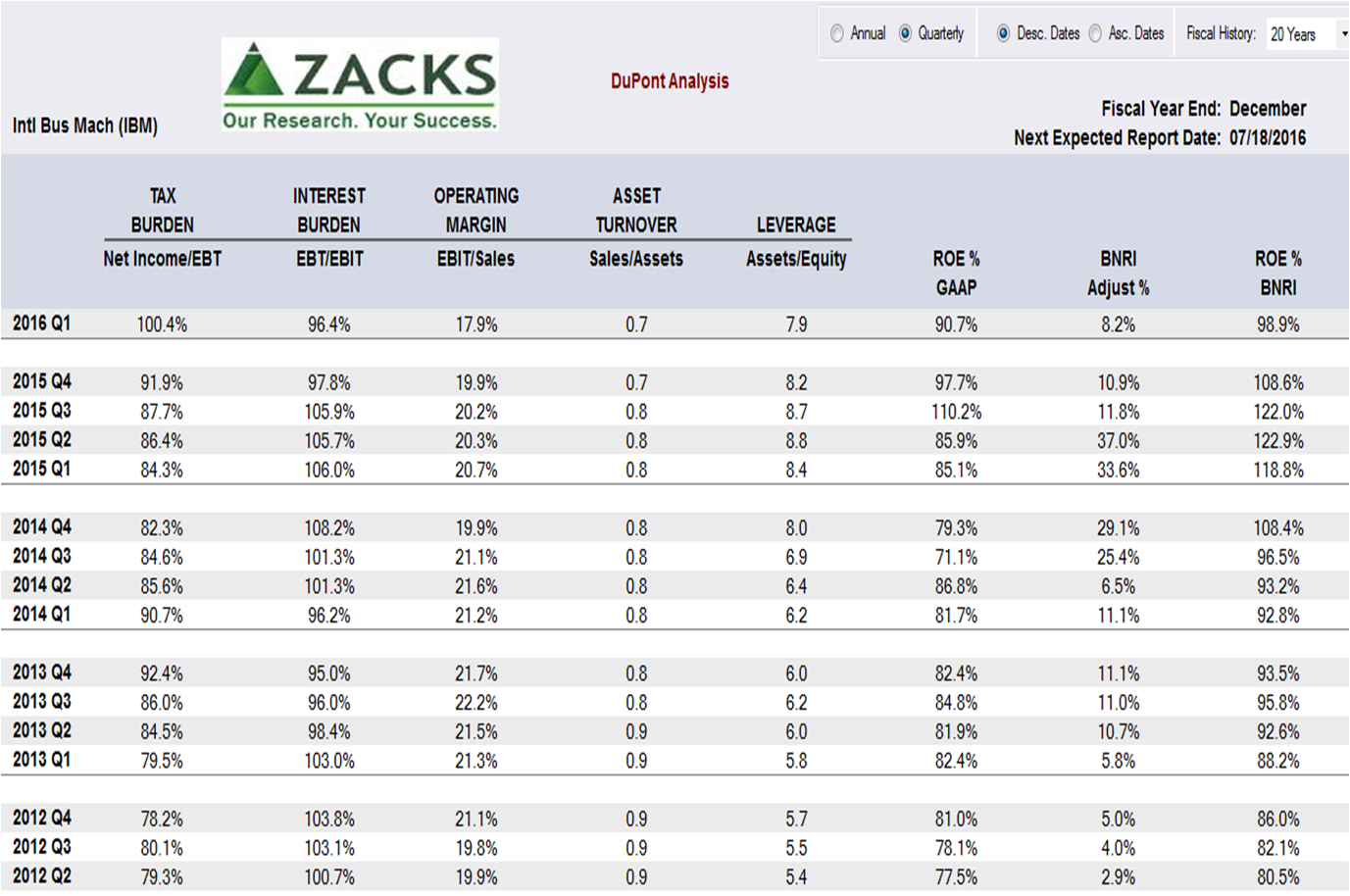

Rewind your mind back to university… From whom did you get better investing advice? From your financial management professor or your financial markets professor? For many of us, it was our financial management professors. Why? They taught us about causes of improved financial performance, and forced us think about financial magic versus business models. To help us fit the pieces together, they illustrated with trees of ratios based on the DuPont analysis model (created way back in 1912 by Donaldson Brown of DuPont and later head of Finance at GM). For these professors, management mattered.

Rewind your mind though our stock picking series here at FDF… The market has been struggling after an overdose of Quantitative Easing as seen in strain gauges. Thus, success starts with a macro strategy. In a sideways market, smarter stock-picking matters. For stock-picking, Step 1 pictured the value of picking the right stock dots, Step 2 busted myths about investing styles and Step 3 illustrated how industries don’t matter for investors (they do for traders). We’ve also demonstrated why ratios such as price/earnings are “broadsheet relics.”

Step 4 is about what matters for smarter stock-picking – finding the right factors.

A common pool from which to select factors is the DuPont analysis model. Note: These financial management ratio factors are “bottom up.” These are different from factor models that are “top down” using market data-related measures such as market capitalization, book/market and price/earnings.

Over the past 100 years, several flavors of DuPont analysis have been developed. A high-level view from Zacks Research System (ZRS) is shown below as we discussed in, “Three errors to avoid in examining earnings.”

Yet, which ratios matter most? Two related approaches are helpful.

Yet, which ratios matter most? Two related approaches are helpful.

- First is to wash with statistical techniques, looking for ratios with the strongest associations to total shareholder return (price and dividends). After finding the strongest statistical relationships, the challenge is to then find causal relationships – the coveted “economic mechanisms.”

- Second is to start with known causal relationships/economic mechanisms drawn from business management methods, selecting those based on business model dynamics to find the strongest predictors. The 4Rs help in factor-finding as discussed previously in, “4Rs help you see the shift.”

The 4Rs are criteria for selecting factors used in business-model based investing. The 4Rs also help other fundamental methods adjust to shifting situations.

- Rare – scarce is valuable. For example, today revenue is scarce, 15 years ago net income was scarce

- Right – financial statement line items less subject to manipulation

- Reflective of powerful and durable value position

- Relative for each measure to: industry, sector and economy

Example from B-School

Remember first-year B-School case study questions? Q1: What might be lurking in a cash-rich company? A: Not investing, not growing revenue. Q2: What might be hidden in a high sales growth company? A: Burning cash too fast. Those are case studies. What’s the actual data for S&P 500 member companies?

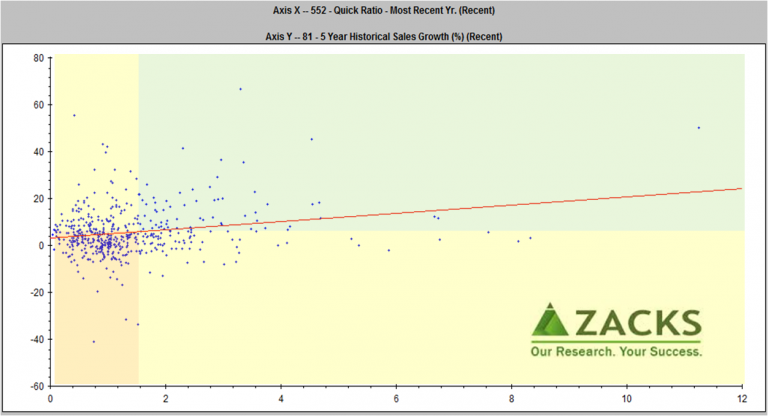

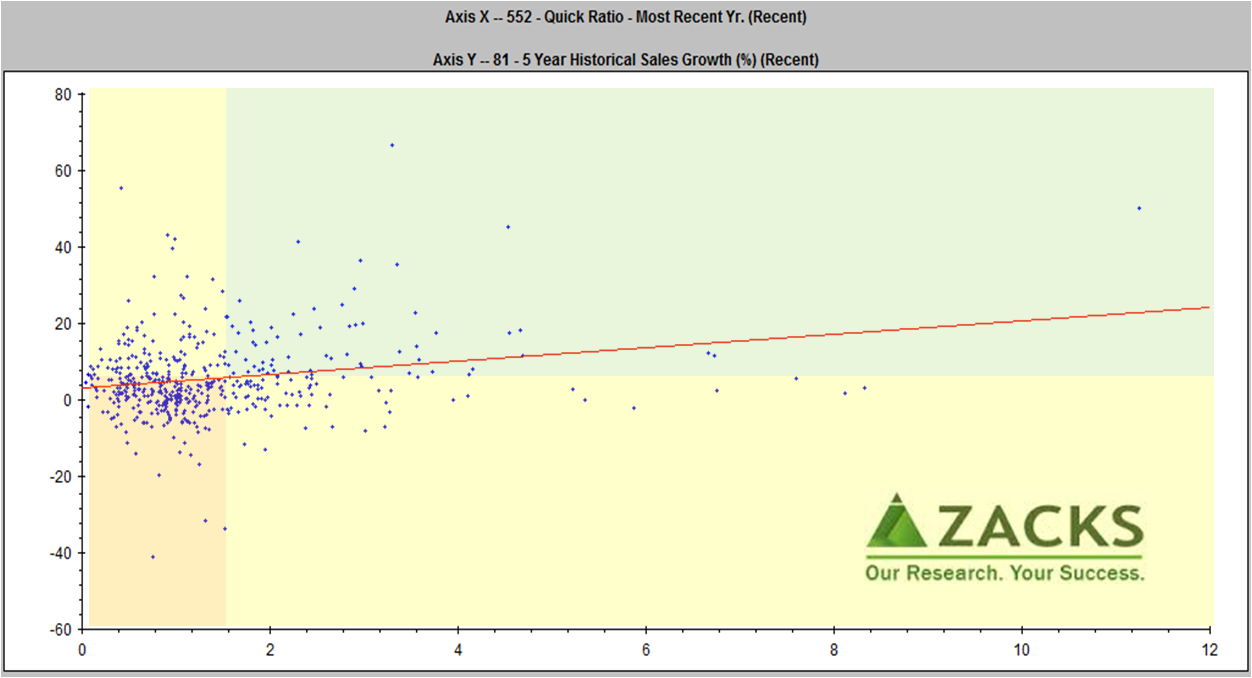

A scatter plot paints a picture:

- Companies below average in either sales growth or quick ratio are in the yellow areas below. These need management improvement. If an investor has high-confidence in the improvement plan, the stock could be an opportunity.

- Companies below average in both revenue growth and quick ratio are in the orange area. These are generally avoided, unless using an event-based strategy and expecting a big change.

- Companies above average in both are in the green area. These are potentially persistent higher-performers.

Notice the versions of the measures selected for persistence: five year sales growth and a balance sheet ratio of accumulated liquid assets.

Notice the versions of the measures selected for persistence: five year sales growth and a balance sheet ratio of accumulated liquid assets.

These and other measures can be selected and applied in various ways. When back-tested, the right ones show strength as we’ve mentioned previously.

Yet, to work best, fundamentals need their “bookends,” macro strategy on one side and risk management on the other.

Bottom line:

- Fundamentals that matter reflect a meaningful cause

- 4Rs help find factors with more predictive power in today’s situation

- B-School basics provide an enduring view of business models