Despite buzz about “buying industries,” industries are not appropriate plays for most investors. Why? Today’s data and tools have made that “rough cut” approach obsolete. Instead, investors should look to the “fundamental farm” to more easily buy into their desired gain-driving characteristics.

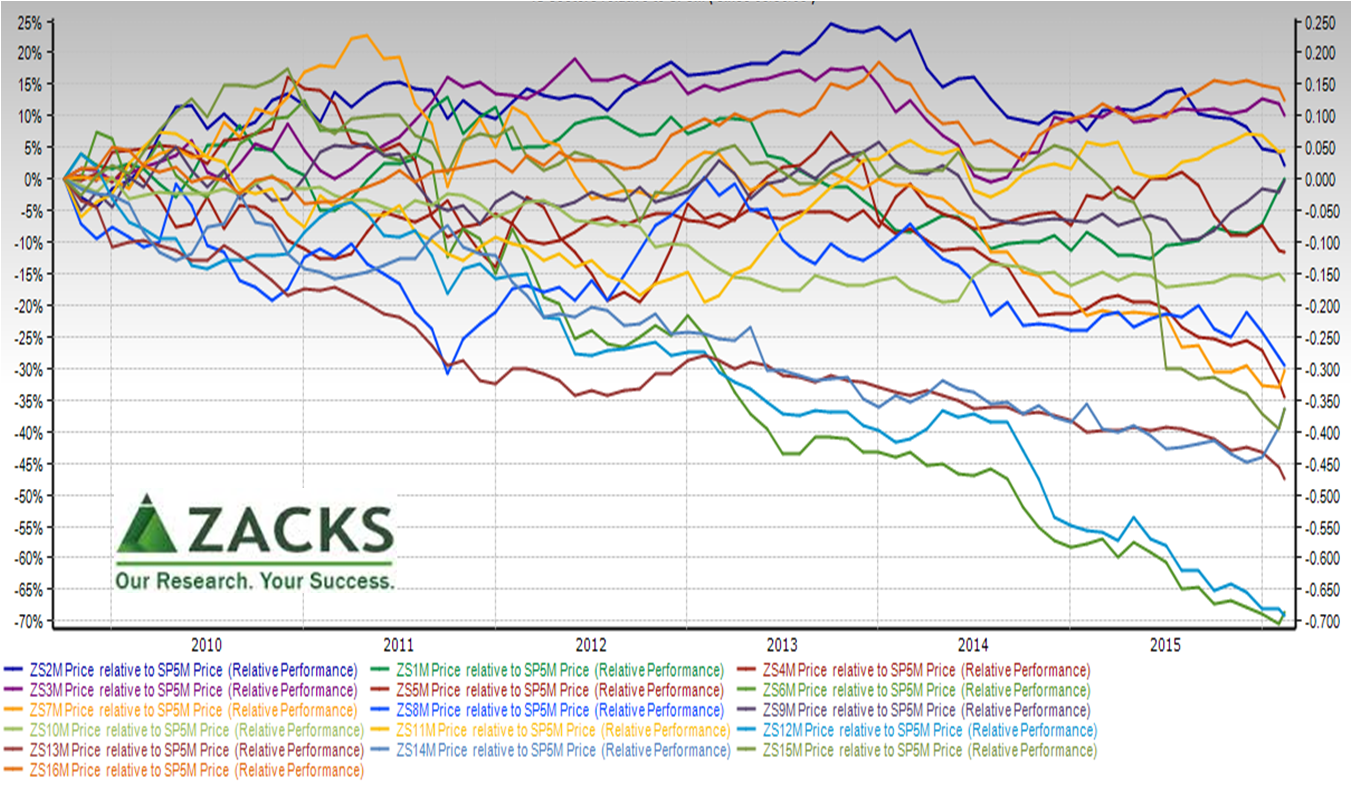

It’s tempting to see a chart like this and then buy the winning sectors. This chart is especially helpful because it uses the Zacks Research System 16 sectors and each is shown relative to the S&P 500 benchmark. Are you ready to buy the top sectors?

The problem is that the winning sectors change leads depending on the historical time period.

The problem is that the winning sectors change leads depending on the historical time period.

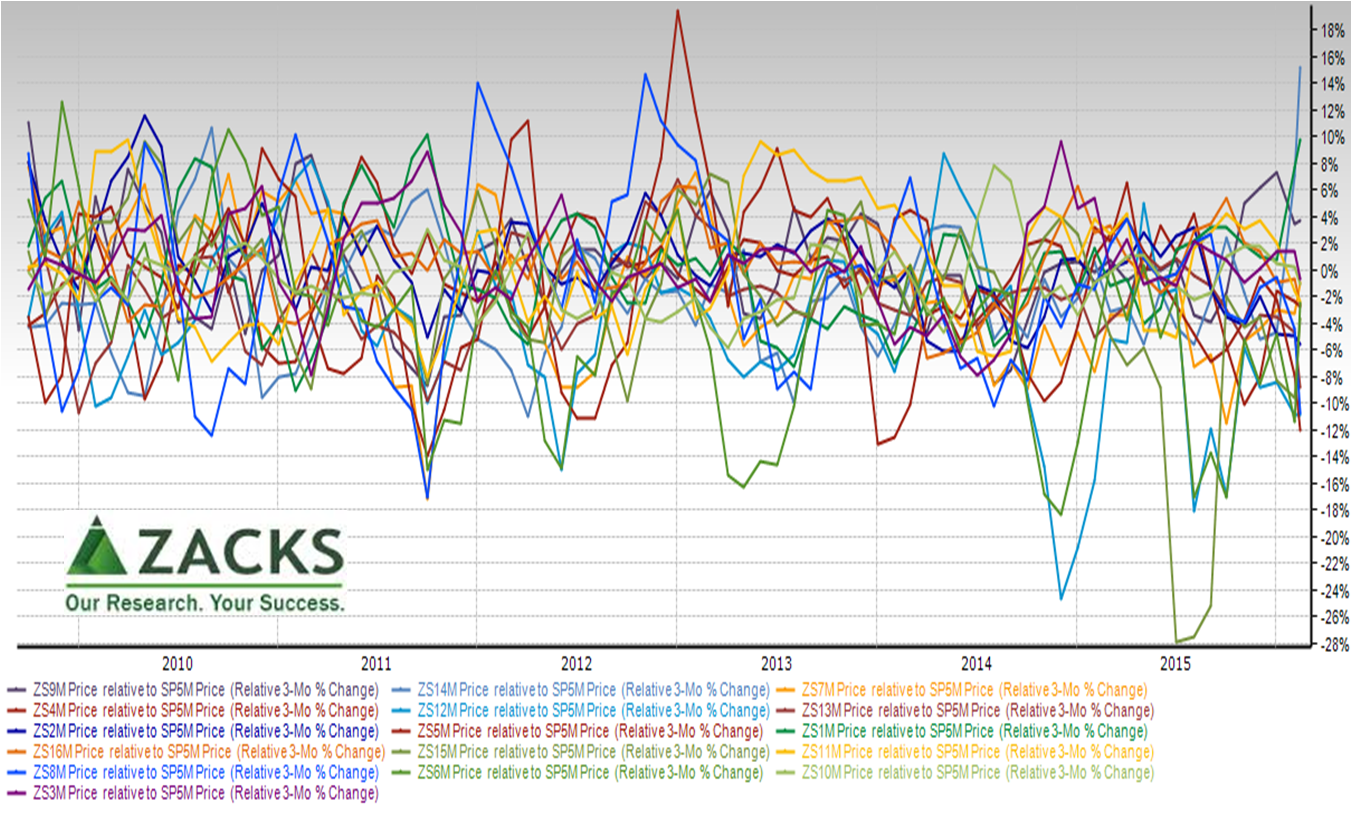

More helpful from ZRS is this chart showing leaders changing in 3 month intervals.

Are you still ready to place your bet?

Pondering this problem, people might think they should instead…

Pondering this problem, people might think they should instead…

- Buy less volatile and more defensive Consumer Staples and Utilities that are also current chart stand-outs

- Buy sectors or industries going into cyclical highs and then sell as they fall

- Use a long-short strategy on sectors or industries at cyclical highs and lows

But, thinking a bit further they realize…

- For stability and defense, simplify, avoid the sector noise, and instead focus on stability fundamentals. ZRS calls this their “earnings certain” approach with their Zacks Earnings Certain Proxy. We discussed this in Step 2 of this series – “Don’t be fooled by investing styles.”

- For cyclical tops, simplify, avoid the sector noise and instead focus on cyclical fundamentals – also discussed in Step 2 of this series – “Don’t be fooled by investing styles.” If also playing bottoms, then it becomes a long-short strategy. Caution as cyclical approaches require more frequent rebalancing.

- More frequent rebalancing slides into trading. If so, then trading approaches can be explored. For example, one group of quantitative investor-traders avoids sectors and instead focuses on factors such as momentum, value and size. Another group focuses on sectors using technical and chart analysis. Many passionate fans of each approach.

Data visibility reduces stock-picking risk

At this point, many investors are still haunted by the conventional wisdom, “buy sectors to diversify across companies.” Is this true? No, it’s no longer true in any practical way.

- First, because conventional wisdom assumes a high cost of getting data and analyzing companies. That changed dramatically with the U.S. SEC’s EDGAR company database and then tools like ZRS that add more data sources, and provide powerful analytics and visualization. For more on data visibility, see Step 1 in 2016 — Buy the right stock “dots”

- Second, because stability/earnings certain and cyclical strategies are focused on the factors that drive desired outcomes — and are easier to implement

- Third, because today’s tools enable digging into “fundamental farm” financial measures that reflect tangible products and production that grow Total Shareholder Returns (TSR) – for example, business model-based Investing.

Companies vary within sectors

“Fundamental farm” factor differences are missed when companies are clumped together. For example, today…

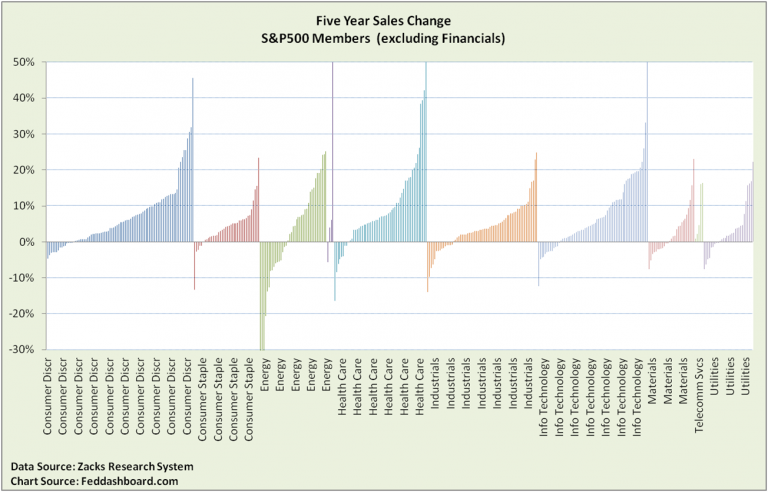

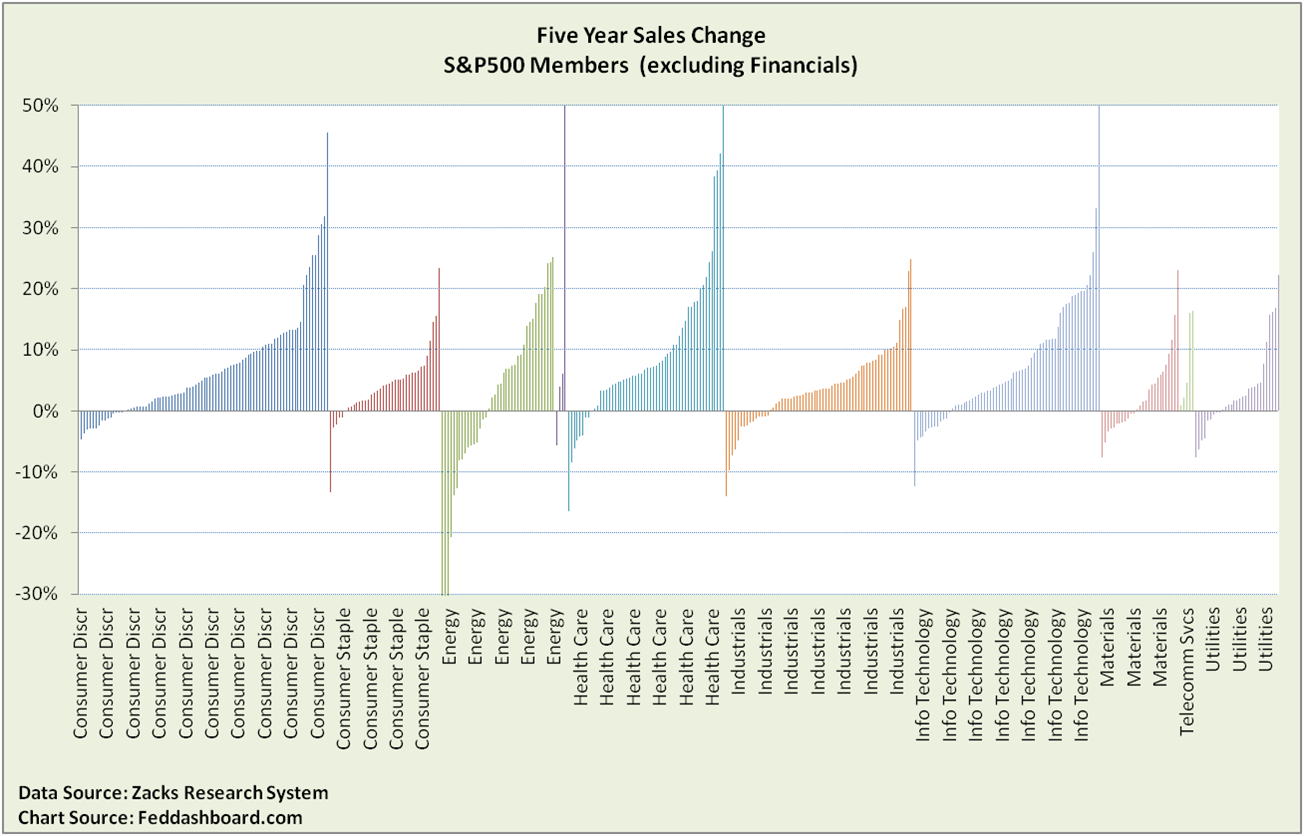

Revenue growth is rare and variations within sectors are wide.

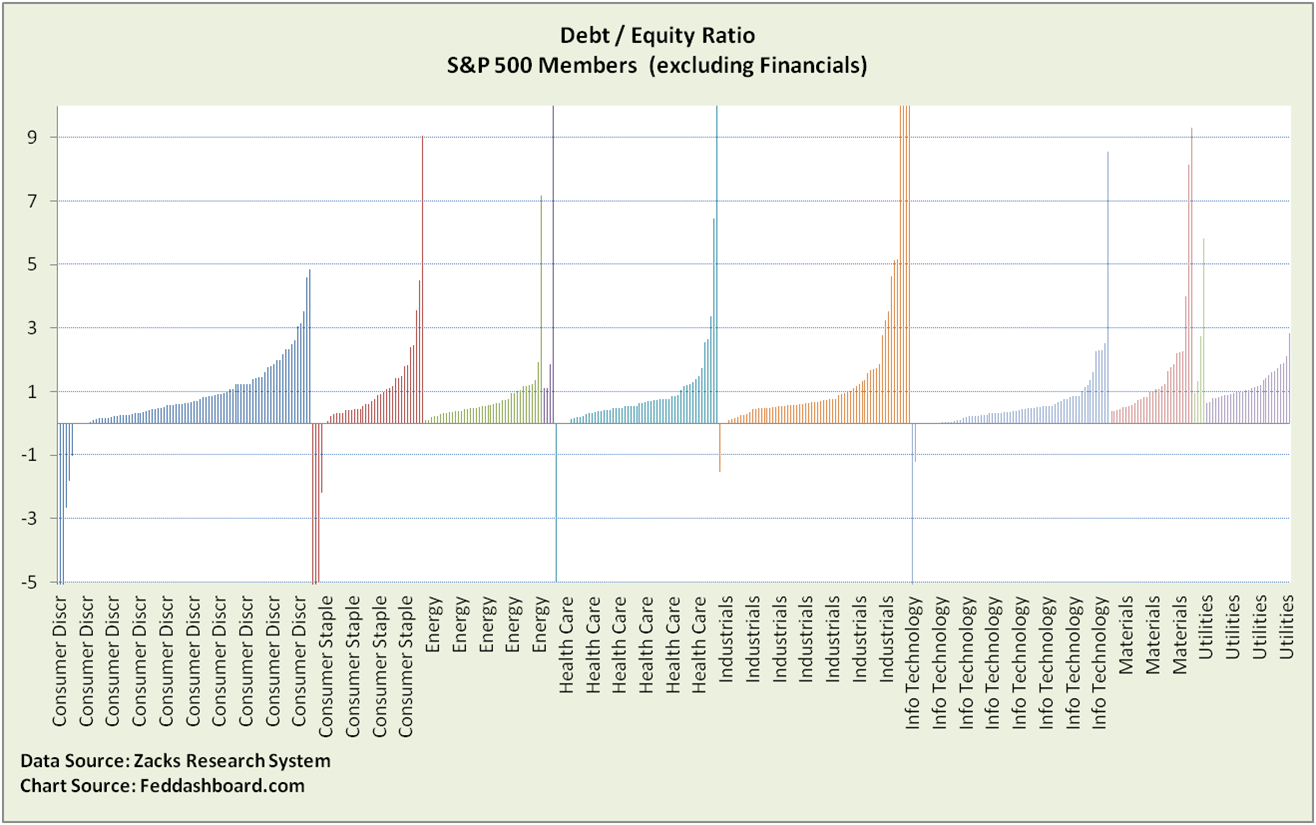

Note: Axis trimmed on this chart and chart below.

With risk in focus, so is debt/equity ratio – again, wide variation within each sector.

For more, see Who are the 5 captains of corporate cash? and Avoiding sales submarines that submerge S&P500.

For more, see Who are the 5 captains of corporate cash? and Avoiding sales submarines that submerge S&P500.

These wide variations within sectors create opportunity for stock-pickers.

Bottom line

- For investors rebalancing every six months or more, sector/industry plays are usually inappropriate

- Stability/earnings certain approaches deserve consideration given past performance – as always, no guarantee of future performance

- For investors with time and energy to be more active, cyclical long-short strategies can be considered – with appropriate cautions

- For any investor, today’s data visibility tools make it easier to dig into the “fundamental farm” of growth to find superior risk-adjusted return