2 October 2014

Across the pages of The Economic Picture Book and Feddashboard.com, 4 points are reinforced.

1. Domestic destiny derailed by deleveraging, demographics, dilution – and disjointed regulation

- Deleveraging includes household and government, and not only debt service, but also total levels

- Global includes:

- From a monetary policy perspective, stimulus being diluted if funds move to other countries

- From a fundamental perspective, skills & capacity, and price & quantity affecting domestic hours worked and wages

- Disjointed regulation produces drag on non-financial companies, banks and market structure

These and other factors have combined to foster an environment in which:

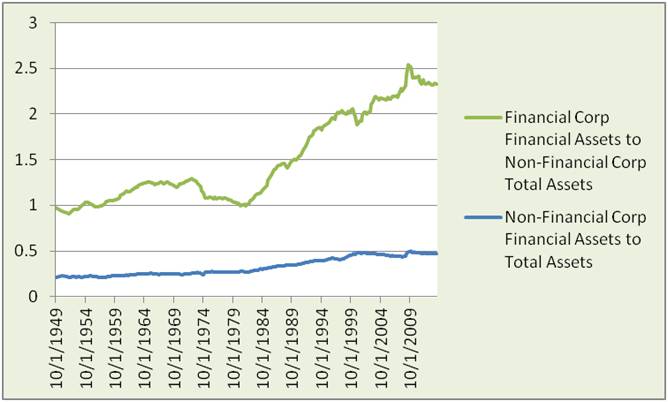

- The financial sector as grown autonomously beyond the real goods and services sector. In effect, the financial sector is too often scrimmaging with itself, instead of playing a real game with nonfinancial companies.

- Bank lending is mismatched with needs of nonfinancial businesses.

- Within SP500 companies, also occurring is the rise of CFOs in CEO clothing – CEOs more adept at cost cutting and EPS engineering rather than creativity, innovation and organic growth. About 1 in 3 CEOs captain ships with 12-month revenue decreases.

- Households too often became stuck in a health trap

2. Pressing problem for households and business is weak real growth

For households:

- Weak real growth in wages and salaries per capita since about 1999.

- At about the same time, workers hit the wall, no longer receiving the benefits of productivity gains as they had in the past. As “The Wall” and other pictures show, this is new in post-WWII history in technology, productivity and wages.

For public companies, weak real revenue:

- SP500 members, if treated as a country, have been in recession for about the past 8 quarters. They might have snapped the losing streak with about 1.8% real growth in 2Q2014 – next quarter will clarify.

- About 1 in 3 CEOs are captaining ships that are leaking in revenue terms, dragging down the SP500 overall.

- EPS engineering with debt-equity swaps and buybacks doesn’t make up for revenue weakness.

- Note: SP500 measures have a bit of upward bias because revenue can grow when a member companies acquires a non-member and other ways.

- Business emphasis on cost-cutting over revenue is also made clear in that improvements in productivity have not been translated into revenue growth.

- In technology, too many CEOs seem to have forgotten Henry Ford’s lesson.

- Assembly lines simply made an activity more efficient.

- Cars for common people were “high torque” (literally and figuratively in the sense of discontinuous innovation) and “ripple effect” in changing lives and economics.

- Competition from low-cost overseas competitors combined with languishing demand, may have caused many U.S. companies to focus on efficiency at the expense of innovation.

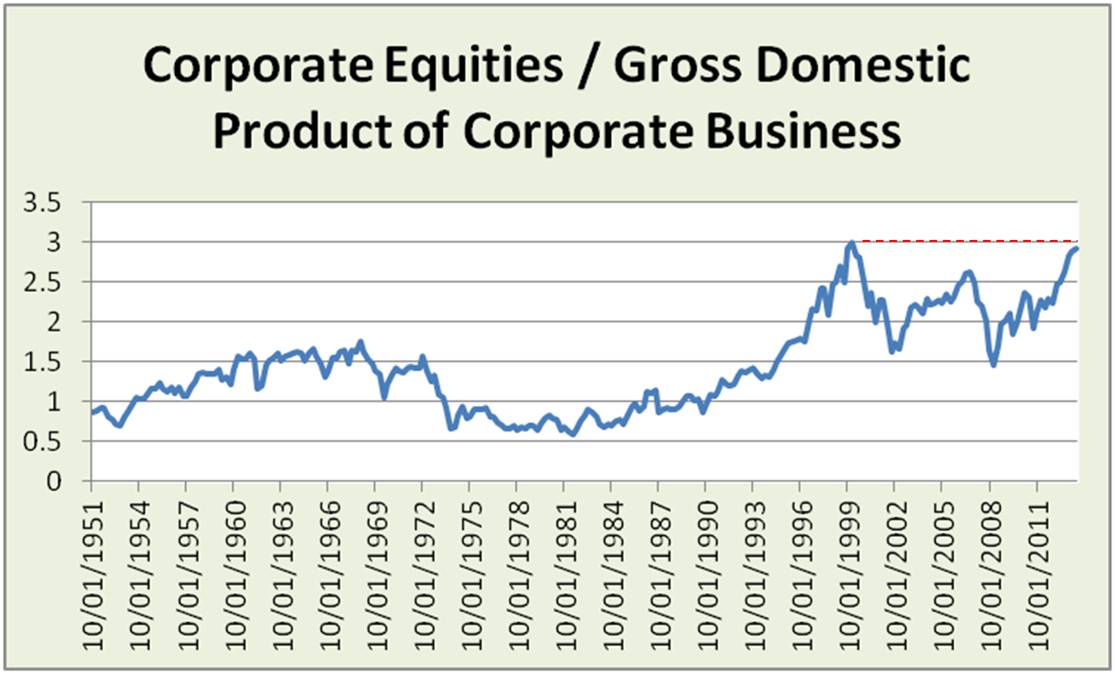

3. Price popping pressures

Given strain between financial markets, and real goods and services markets, consider what could let the air out of the financial asset bubble.

- Rapid decompression

- Market: insufficient liquidity and ability to deliver

- Strain exposed, spooking it, especially if traders are uncertain of how to read these markets

- Slow leak

- Interest rates — affects on savers and debtors

- Households — demographics, savings, medical & more costs

- Business — cash haves and have-nots

- Scarce resource (commodities and input goods) — differential affects on prices

- Government — debt and regulation

- Geopolitical and pandemic

4. Our objective – organic growth

Given debt, demographics, globalization, regulation and corporate action, best measures of growth include:

- Risk-adjusted return

- Real wages and salaries per person

- High-torque and ripple effect innovation

At the economy level, we can hope for bright spots in:

- Learning the Henry Ford lessons and focusing on the right technology

- Increasing energy independence

- Efficiency in using scarce resources

- Regulatory reform that could enable companies to create value at little federal budget cost

- Note: housing should not be seen as a salvation, without paying a painful price

At the company level, helpful measures for investors include:

- Rare – scarce is valuable. For example, today revenue is scarce, 15 years ago net income was scarce

- Right – financial statement line items less subject to manipulation

- Reflective of powerful and durable value position

- Relative for each measure to: industry, sector and economy