The debate about the GDP measure gets muddled when people confuse three questions: What do we really want to know? What do we need to measure? And, how well does that measure work? Answers point to the top priority – adjusting for improved product quality.

Debates about what Gross Domestic Product (GDP) is intended to measure go back to the 1930s when the question was whether government sector should be included. The World War II need to count military production gave a firm “yes” answer. Since then, debates have continued, but are often confused simply because debaters talk past each other. To help you gain clarity, here’s your short guide to the debate in three questions…

1. What do we really want to know and why, given our current environment?

Is it about “well-being,” “happiness,” overall financial condition, value creation, or income and production?

Many people wrongly assume that because GDP is a widely use statistic, it is an overall measure of national health. No, it was never designed to be any more than your income is equal to the health and happiness of your family.

GDP is the summary measure in “National Income and Product Accounting” (NIPA) published by the U.S. Bureau of Economic Analysis (BEA). NIPA is a combination income statement and production accounting statement. So, out of scope are measures of leisure time, distribution of net assets or income within a population, pollution costs, and mental and physical health. Those measures are helpful and published in other datasets.

Is it about overall financial condition?

GDP is part of income and production (cost accounting) statements. So, a balance sheet is out of scope, although GDP does include new investment. If you want to know how much spending is fueled by consumer and business credit, or how much debt burdens people, businesses, and governments, the balance sheet is found in the Financial Accounts of the United States, from the Federal Reserve System Board of Governors.

Is it about nonfinancial value creation?

GDP is focused on items that are legally traded for a price. It also includes production of government and nonprofits such as education, defense, and medical care where data are available. So out of scope is value created at home (e.g. child care, cooking, repairs, construction, or in-home manufacturing using a food processor or 3D printer), neighbors helping each other fix cars, informal sharing, volunteerism, barter, or gray or black markets. GDP also doesn’t include benefits of increased breadth of choices (from video channels to coffee flavors), faster product purchase or faster product improvement (shorter product lifecycles).

By counting financial items, it also means that it includes transactions resulting from “bad” situations such as spending to replace what was lost due to theft, natural disasters, or other casualties. While new assets are mostly replacing lost assets, the producers of those new structures and products do earn income.

The fastest growing change missed in GDP is “demonetizing” GDP – products with prices falling fast or with no price to end users (although users may compensate the vendor by providing information, giving up privacy, watching advertising or donating). Demonetizing products are the most extreme cases of the need for price-performance or quality adjustments made to products by the U.S. Bureau of Labor Statistics (BLS).

- Consider a smartphone; the price might go up by 10% from the old model, but benefit by 30%; then the price drops as it becomes yesterday’s model.

- Consider a drone; is it a toy or game-changing business tool to a movie producer, surveyor, or fire department? It’s not even clear where to classify it, but prices are dropping like a rock and performance sky-rocketing (pun intended).

Just as low marginal cost products are in scope to business accounting, these products are also in scope to NIPA, especially as there is still an average product cost from costs were incurred developing the product, creating a distribution platform, ongoing maintenance, servicing customers and more.

There is a pressing need to better adjust products to reflect improved quality/performance, especially where our economy is structurally changing. This includes digital goods and services, goods auto-magically becoming services through subscriptions (this shift also distorts goods and services comparisons over time, and product averages within those categories), government and nonprofit services where output is often valued only at input costs, and business investment in more efficient production.

What should change?

- We’ll always need a measure of income and production, there are other measures of well-being and balance sheet, so GDP does not need a scope change.

- GDP does need to be clearly understood by policy-makers and used appropriately.

- GDP does include items at prices that have been falling for decades through the tech and trade transformation, so quality adjustments are the top priority for improvement. Whether business, government or nonprofit, the need is to better count products that are providing more benefit than ever, but their investment, input costs, and/or price are falling.

- Production of growing items currently out of scope (such as products 3D printed by end users, sharing or work at home) should be tracked and updated so that falling consumer purchases are not mistaken for falling total production.

2. What do we need to measure to answer our question?

Focusing now on just what GDP is intended to measure, how is it counted?

Counting is done three ways by the BEA.

- First is the “Consumption” method. This sums up consumption, private investment, government, and net exports. This is the “C+I+G+NX” formula drilled into the heads of Econ 101 students.

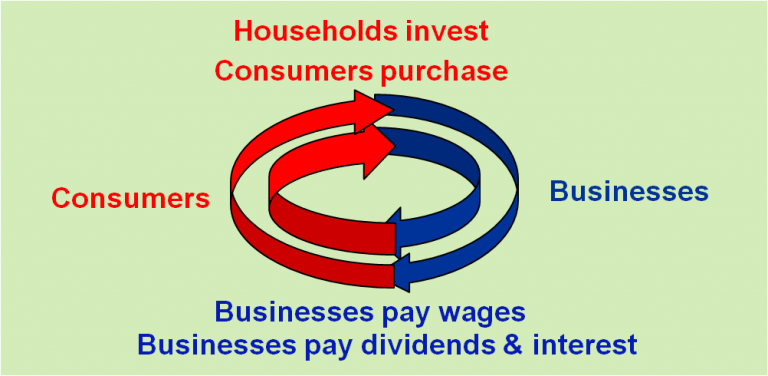

- Second is the “Income” method that sums compensation to employees, taxes on production and imports (income to government), net operating surplus (akin to business profits) and consumption of fixed capital (depreciation in econ-speak added back to profits as a non-cash charge).

- Third is the “Value Added” method that sums the value added to a product at each stage of its production. This is the central method for U.S. industry accounts and is the preferred method overall in European and other countries.

GDP calculated by each is equal in concept, but practically there are discrepancies, prompting analysts to track the differences and governments to report the average of GDP measures.

Is government included?

- IF the question is about how much income and spending is happening in an economy, then yes, include government because government pays workers, business sell products to governments and governments invest in physical assets. BUT, large government sectors can obscure the health of voluntary decisions about private transactions.

- IF the question is about voluntary decisions, then subtract the government sector and look at private (business, household and nonprofit) actions.

3. How well does that measure work?

Given data gathering and adjustments

Each element of NIPA that sums into GDP is more or less accurate depending on how easy it is to measure. Measures start with collecting source data that is concerned with sampling errors, method of collection (e.g. store scanners versus people visiting stores, or survey response accuracy), calculations and adjustments (e.g., quality adjustments, inventory & depreciation, housing imputation, seasonality), and then residuals and discrepancies with alternative measures are compared. This is the continual improvement process of the statistical agencies.

In other economic measures

Formulas that use NIPA source data need to be updated to what is most relevant for today’s situation. For example:

- When Intellectual Property Products started to be more fully measured, this increase cascaded into an increase in inputs to the Multifactor Productivity (MFP) calculation that resulted in a decrease in growth of MFP as we’ve written previously.

- Potential GDP calculation excludes resources available today as we’ve described previously so it appears lower than it is.

Again, nothing wrong with NIPA – other formulas need to be updated.

Bottom Line for Investors:

- The investors behind FDF don’t use the summary GDP number. We’re far more interested in the detail to aid in better stock-picking as we’ve illustrated previously.

- Our traders also aren’t as sensitive to GDP releases unless the Federal Open Market Committee has played-up a specific release as a stronger influence on an interest rate decision.

- Monthly or quarterly numbers matter much less for investing than persistence in trends in products or industries. The more persistent trends help craft consistent portfolios for more consistent returns. This is where NIPA shines.

Data Geek Note: More about quality adjustments at these BLS pages: Producer Prices and Consumer Prices.