June 6, 2015

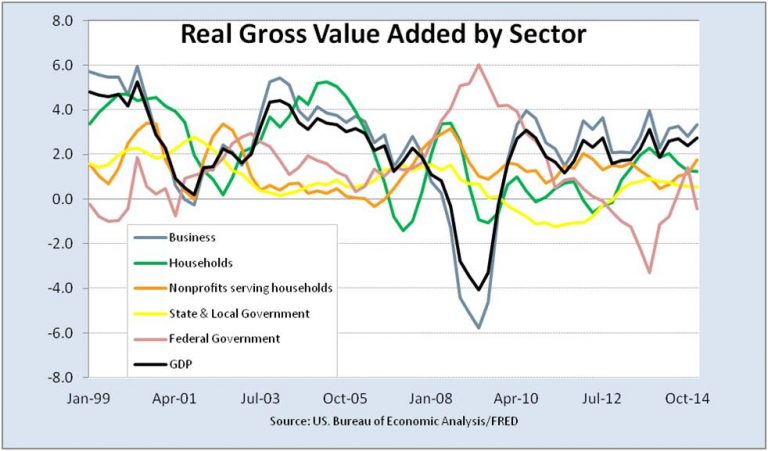

Is business dragged down with GDP? Are business fundamentals matching the Fed-fired stock prices? No and no. Business has been the healthiest part of GDP for the past 5 years. Yet, while chugging along with historically good stability, growth in equity prices outstripped growth in business value added.

Businesses are about 75% of our economy as described in “From earnings to economic releases – you can profit from knowing how numbers add up.” Other sectors include households and nonprofits serving households, and government.

What’s measured in this sector view?

- Value added looks at what is created from inputs – this is especially helpful when looking for growth sources. It’s a different lens than the final spending view.

- At the broadest level, business value added is pretty close to business revenue.

- Household valued added is measured as “services of owner-occupied housing” (treating housing as if home owners were paying rent to themselves) and the compensation paid to domestic workers.

- Nonprofits serving households include health, recreation (including sports centers, performance arts, museums and libraries), education, social services, religious and professional organizations. They are measured in costs as their nonprofit “sales” are often below market prices.

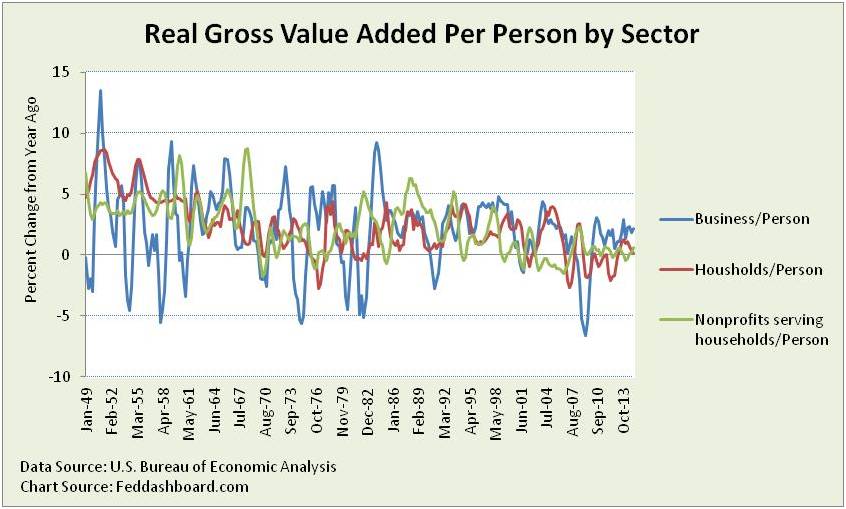

To see more clearly over decades, data above is normalized for changing prices and population. To reduce seasonality, this picture is percent change from the same quarter a year ago.

To see more clearly over decades, data above is normalized for changing prices and population. To reduce seasonality, this picture is percent change from the same quarter a year ago.

Over time, Business growth dominates in the good times. Since 1Q2010 Business has posted the strongest growth.

Households have had the least fluctuation, mostly driven by ability to consume housing though income and debt. Nonprofits have been influenced by health care and education public policy.

To more easily see variations, the picture below begins 1Q1999, just before the dot com bubble burst.

- Both are on an uptrend with relatively little variation over the past 5 years compared to post-WWII history.

- The recent trend is the opposite of 1Q2004 to 2Q2009 when growth rates were slowing.

- For monetary policy markers, this health in Business can be seen as a reason to raise interest rates.

GDP and Government

- Federal government spending dropped starting 2Q2009 and rebounded in 4Q2013.

- When GDP is viewed as a measure of transactions, taking a dollar of government spending out of circulation mathematically reduces GDP.

- When GDP is viewed as a measure of economic health, the question is whether a government decision to tax and spend reflects economic health in the same way as private decisions. Further, a government dollar isn’t free as it comes at the cost of debt or taxing, processing and spending on something other than what voluntary decisions would have done with the dollar.

- GDP “headwinds” are what advocates of government spending call lower GDP due to lower government growth rates. Others see government restraint as a good thing.

For investors, stability in business is good. In evaluating this positive trend, it is helpful to notice:

- Business measured here includes domestic activities of both public and non-public companies.

- Stable and moderate growth pictured here looks nothing like the increases in the S&P 500 and other stock price indices. This is why the Strain Gauge is at historical highs as described in “Situation status and organic growth imperative.”

- S&P 500 members struggling for revenue growth — even with international revenue and the ability to magically grow revenue when S&P 500 members acquire non members. By comparison, the broader Business value added numbers that include private companies look attractive. No wonder money has been made by investing in private companies.

In closing, Business sector growth is reason for optimism. But, don’t get caught up in averages. Find opportunity others miss by digging into details.

- For industry opportunity, Bureau of Economic Analysis industry data can help.

- Zacks Research System analytics can then drill down from industry to company. An example is described in “3 insights for corporate cash – finding health.”

All this leads to the value of business model investing.