The effectiveness of the Fed’s key policy tool to manage our economy may be weakening. We have observed the Federal Funds rate:

- Has not been consistently cascading through credit rates for decades, reducing the benefit to borrowers

- Is not the major influence on most business investment decisions

- Is less influential against the growing forces of global liquidity flows, non-bank lending, and financial regulation

Global influences on the Federal Funds rate include:

- Sovereign debt Credit Default Swap rates and credit risk

- Stability of foreign and domestic banking systems

- Foreign exchange, including interest rates as part of weaponization of economic policy in the absence of sound fiscal and regulatory policy

- Political risk and flights to safety

Investors should pay attention to the increasing influence of global financial markets on interest rates. These influences on interest rates will ultimately impact business and consumer activity.

The Federal Open Market Committee (FOMC) expects their interest rate decisions to change the economy because they expect the Effective Federal Funds (EFF) rate implemented at a trading desk at the New York Federal Reserve Bank to consistently cascade across credit classes from Treasury Bills to business and consumer borrowing. Today, we look at how well other rates track the EFF.

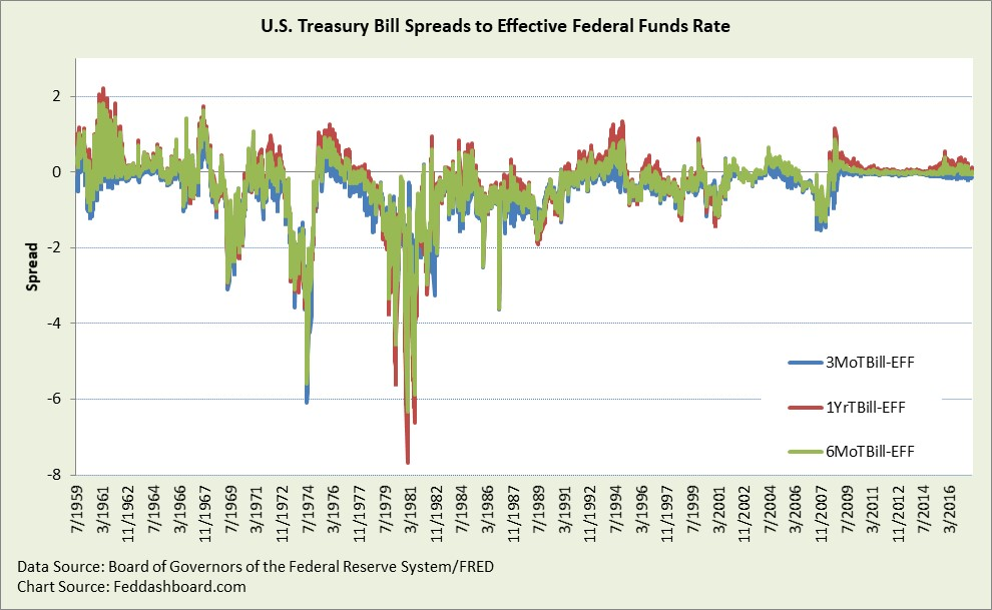

Treasury Bills are low-risk so they should track the EFF closely. Let’s start by looking at spreads (T Bill minus EFF).

In reading the charts below, the flatter a line, the more closely a rate tracks the EFF.

- Higher spreads since 2015, compared with 2010-2014, have attracted much attention.

- But, today’s spreads are relatively small compared to the larger negative spreads in the run-ups to the mortgage bubble bursting and inflation spike of 1981, and following the oil crisis.

- The FOMC’s quantitative easing (QE) over-powered typical interest rate dynamics to reduce spreads. Now, that QE force has diminished.

In the spreads view above, there are few periods of close tracking — early-mid 1960s, early-mid 2000s, and 2010-2014.

In the spreads view above, there are few periods of close tracking — early-mid 1960s, early-mid 2000s, and 2010-2014.

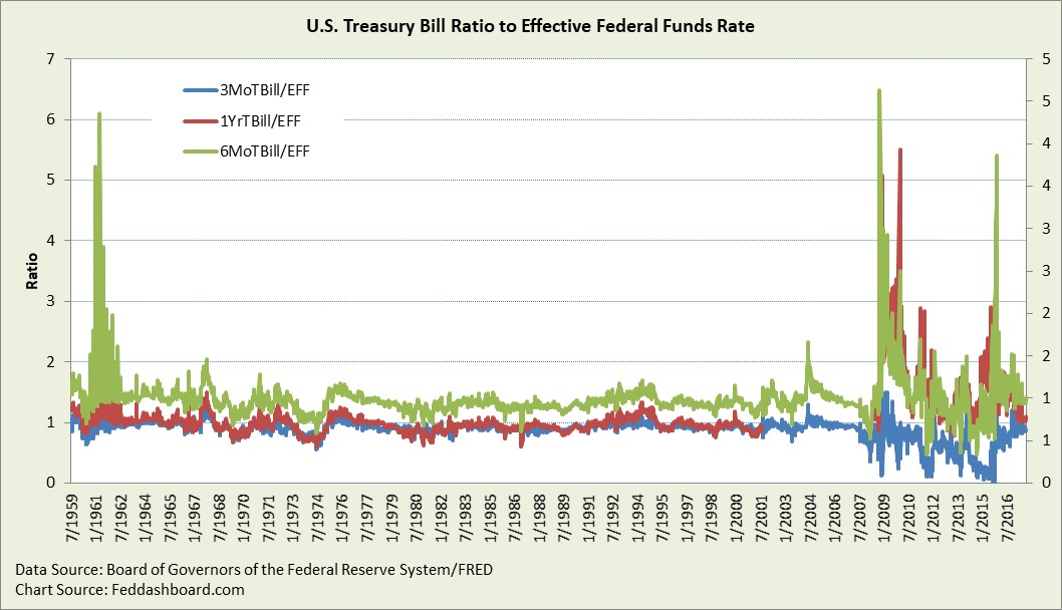

Yet, spreads are not sufficient to evaluate the ability of the EFF to cascade because spreads are a fixed mark-up. More helpful is a proportional view of the EFF rippling through increasingly risky credit classes.

The proportional view is the ratio of the T Bill divided by the EFF. Below, prominent is the original “Operation Twist” of 1961 (repeated in 2011-2012), the beginning of extraordinary monetary policy in late 2008, calming a bit, then picking up as interest rate speculation began in early 2015, and then calming considerably in 2017.

Comparing the tracking between the spreads and ratios from 1964 to 2006, the standard deviation (relative to each mean) is over 10x greater for spreads.

Comparing the tracking between the spreads and ratios from 1964 to 2006, the standard deviation (relative to each mean) is over 10x greater for spreads.

Switching to Treasury Bonds from Bills, the spike is only 3.35 for 20-year bonds in 1961 and 56 for 20-year bonds in 2011.

But, government securities, with lower risk, are more relevant for corporate cash management and savers than for businesses borrowing to invest or consumers borrowing for “big ticket” durable goods.

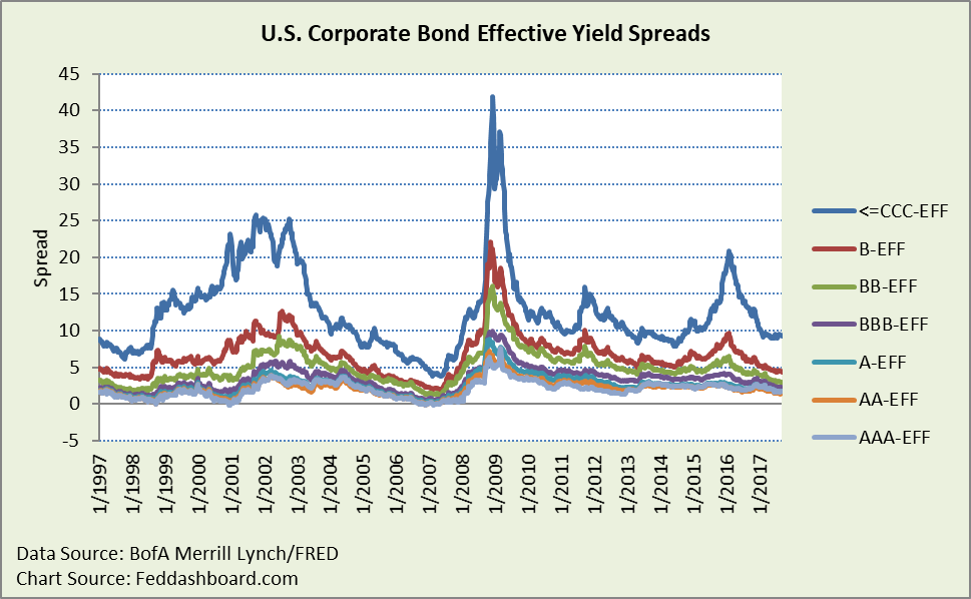

Corporate bonds provide a borrower’s perspective

Corporate bonds have much greater spread divergence and trends (up and down) than Treasuries.

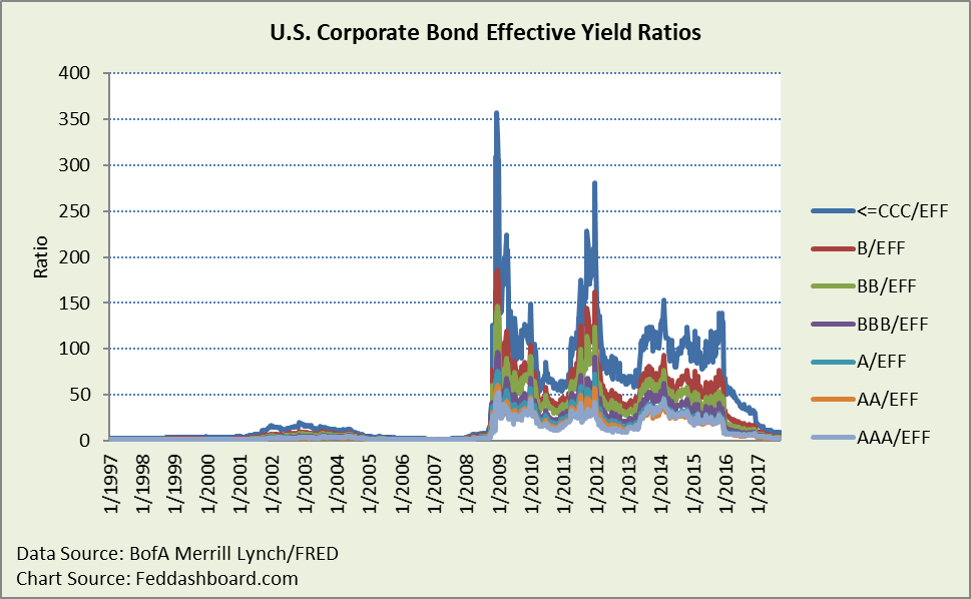

The ratio view shows gigantic divergences with calming starting late 2015. The enormous magnitude of 2008–2016 visually hides big divergences in other years.

The ratio view shows gigantic divergences with calming starting late 2015. The enormous magnitude of 2008–2016 visually hides big divergences in other years.

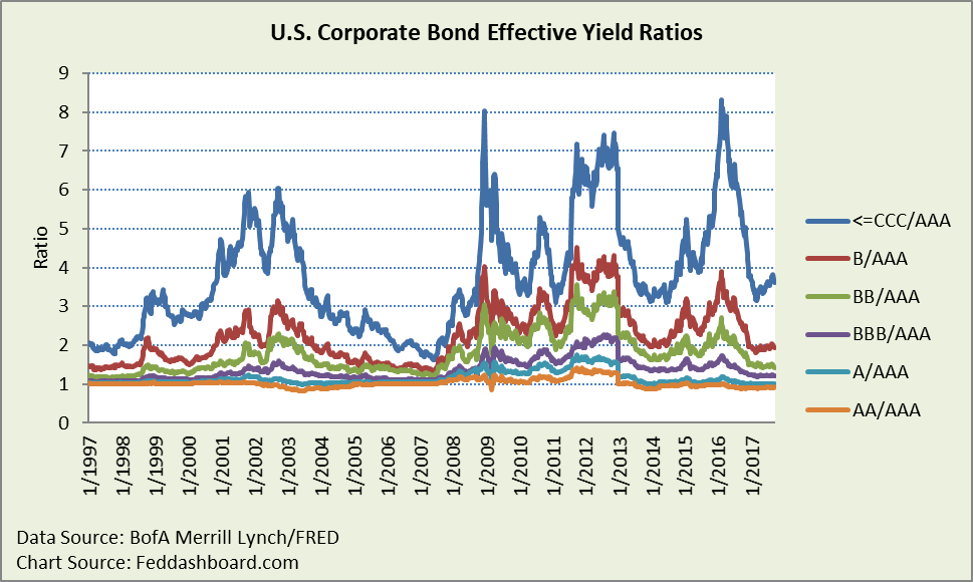

Because corporate bonds and the EFF have different duration, the view below shows all classes relative to the AAA rate.

Because corporate bonds and the EFF have different duration, the view below shows all classes relative to the AAA rate.

Above, interest rate increases are higher than proportional for lower credit classes. Differences illustrate how public markets have global dynamics far beyond the EFF, thus reducing the FOMC’s influence.

Above, interest rate increases are higher than proportional for lower credit classes. Differences illustrate how public markets have global dynamics far beyond the EFF, thus reducing the FOMC’s influence.

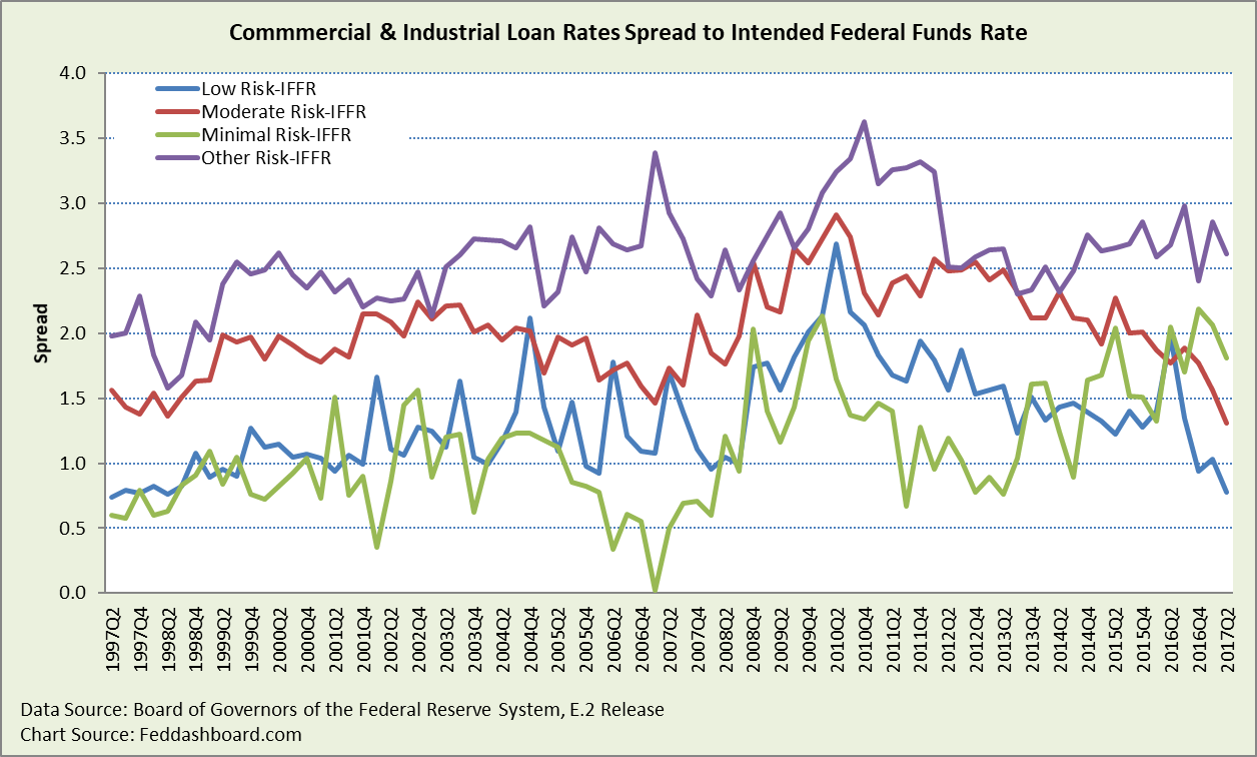

Bank loan rates to businesses seem more influenced by country regulation and the spread-driven bank business model.

Below, the bank loan spreads view is closer to the ordinary understanding of relatively stable spreads. 2Q2017 was historically affordable for low and moderate risk borrowers, but expensive for minimal risk borrowers.

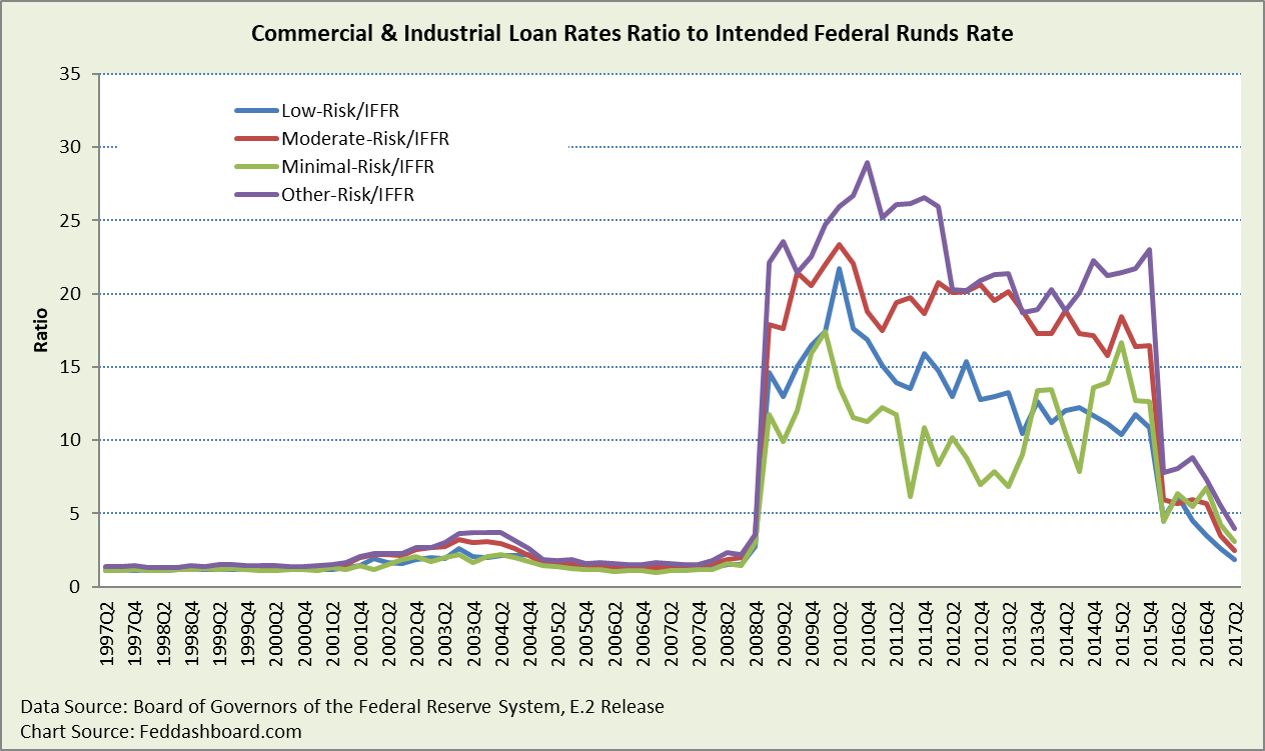

The ratio view again shows borrowers didn’t fully receive the benefit of the lower EFF.

The ratio view again shows borrowers didn’t fully receive the benefit of the lower EFF.

For businesses, these dynamics help explain why investment did not increase as the FOMC expected:

For businesses, these dynamics help explain why investment did not increase as the FOMC expected:

- Business borrowing rates haven’t closely tracked the EFF

- Rates rose to make investment unprofitable for those businesses pushed by Dodd-Frank Act banking regulations out of banks and into expensive gray markets

- Borrowing rate’s influence is lower because debt is only one element of the weighted average cost of capital in the Net Present Value equation used to make business investment decisions. Also, the go/no-go decision includes an evaluation of business risk and uncertainty. To the extent that risk and uncertainty were either higher or businesses felt unable to manage that risk and uncertainty, investment decisions got a “no go.” We discussed this further in “Why lower interest rates didn’t create a boom in business investment – 3 reasons might surprise you.”

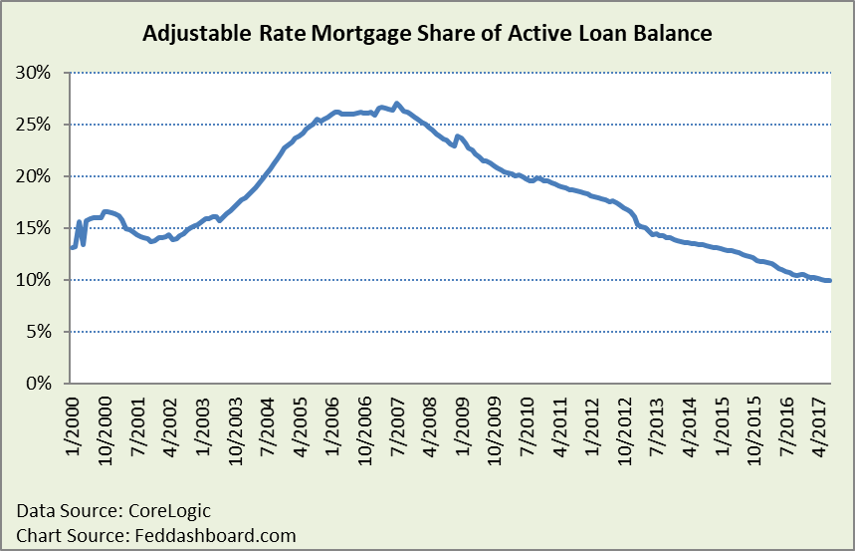

For consumers, the transmission of the EFF will be muted because of change in mortgage composition. Sam Khater, Deputy Chief Economist at CoreLogic remarks that the Adjustable Rate Mortgage percent has fallen from about 27% in 2007 to about 10% today.

The personal and auto loan spreads view offers more stability after the early-1990s, with decreasing spreads both during the easy credit period prior to the mortgage bubble bursting and since the 2009 spike. But the ripple view (not shown) looks more like corporate bonds with ratios up to 140.

The personal and auto loan spreads view offers more stability after the early-1990s, with decreasing spreads both during the easy credit period prior to the mortgage bubble bursting and since the 2009 spike. But the ripple view (not shown) looks more like corporate bonds with ratios up to 140.

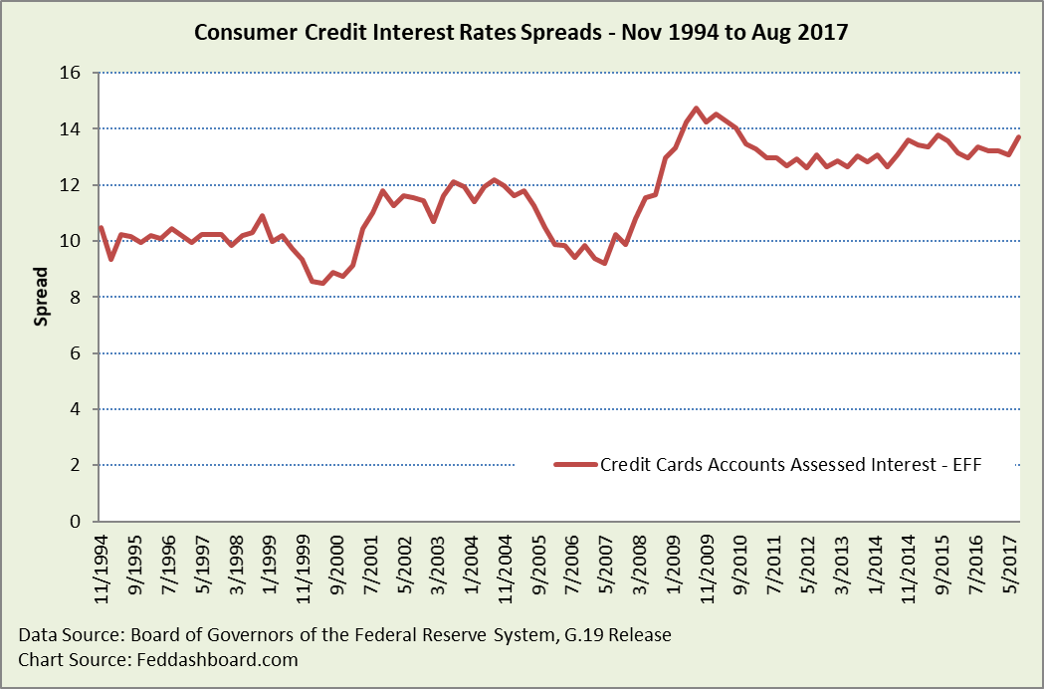

But, shifts in personal and auto loans also reflect longer duration than the EFF. Credit card rate for accounts assessed interest has much shorter duration and is closest to a flat line.

- Spreads step-increased after the mortgage bubble burst and have a slight up-trend.

- The spread view is still a fixed mark-up. The ratio view (not shown) rocketed to a high of 180 from a pre-crash 3 – a lower EFF didn’t fully ripple to consumers.

Complications to consistently cascading interest rates include:

Complications to consistently cascading interest rates include:

Supply & demand

- Global liquidity patterns due to both cash generation and country differences in monetary and financial services regulation

- U.S. nonfinancial companies with cash trapped in other countries for tax reasons lending in those other countries, such as Amazon Financial Services

- Alternative sources of financing, including leasing versus buying (with tax implications), or non-bank (global public markets or family office/wealthy individual) financing of real estate projects previously funded by banks – these non-bank sources are less sensitive to the EFF and more sensitive to returns on other investments

Debt structuring

- Corporate finance decisions (debt-equity substitutions and businesses’ evaluation of risk to their investment plans)

- Regulation restricting credit and increasing financial institution costs

Winners & losers

- Winners: Borrowers who can take advantage of global markets

- Helped, but less than they could have been: Borrowers in regular domestic markets, especially with higher credit ratings

- Losers: Borrowers pushed into gray markets by regulatory policy, where FinTech is rescuing some of them

This exploration of central bank effectiveness continues with “Bedrock of Fed policy is crumbling.”

To learn more about how to apply these insights to your professional portfolio, business or policy initiative, contact “editor” at this URL.