DATA ANIMATION

Fear of deflation is growing. But we need to ask, “Why?”

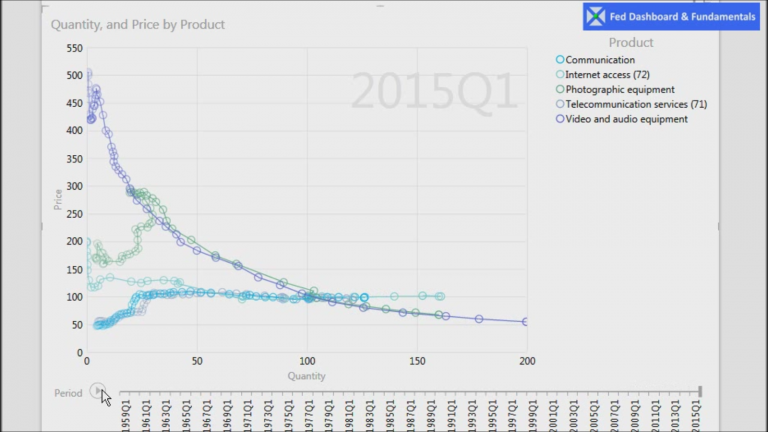

Fear is usually explained by pointing to a price index like this one. It’s the AVERAGE of price changes for ALL consumer goods and services. But averages hide answers.

This animated data visualization highlights several of our analyses on price levels and deflation fears.

For more on prices and PIPE Factors, please explore the Money & Prices and Exponential Technology categories.

Story of the Red Dots and globalization https://feddashboard.com/world-to-u-s-do-you-get-globalization-yet

For more on exponential technology:

- Singularity University http://www.singularityu.org

- Ray Kurzweil: The Coming Singularity http://www.singularity.com/