Yesterday, European Central Bank (ECB) President Mario Draghi presented his remarks at the European Parliament Committee on Economic and Monetary Affairs.

In part, he said “Should some of the downwards risks weaken the inflation outlook over the medium term more fundamentally than we project at present, we would not hesitate to act. The asset purchase programme has sufficient in-built flexibility. We will adjust its size, composition and duration as appropriate, if more monetary policy impulse should become necessary.”

Unlike the U.S. Federal Reserve, the ECB has a so-called “single mandate” for price stability – “The ECB aims at inflation rates of below, but close to, 2% over the medium term.”

Since the beginning of the ECB’s most recent asset purchase program, prices bounced off their January 2015 low to a May 2015 rise before slightly falling – see interactive chart at https://www.ecb.europa.eu/mopo/html/index.en.html.

In theory, extraordinary asset purchases should lower interest rates, bubble financial asset prices and lower exchange rate – all have happened just as in the ECB’s textbook diagram. Then, theory says this will increase product prices, creating a shortage and stimulating production.

The critical assumption is that most products are in a natural state of scarcity or “supply constrained.” In a graph, this means long term ruled by an upward sloping curve – like a textbook supply curve.

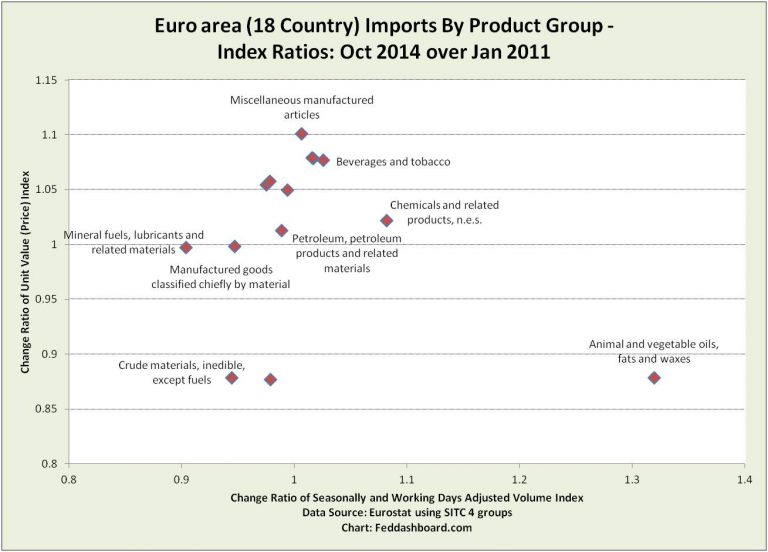

The data reality is that this isn’t true, and hasn’t been true for a long time. Today, the world is less supply-constrained and a long term downward sloping demand curve explains the price-purchases relationship. This is the world of the PIPE Factors, including exponential technology. Most product price increases are really coming through fiscal policy and regulatory requirements.

This is why our past analyses suggested that price increases from ECB asset purchases would be more likely to come from importing inflation through a weaker currency.

Today, we point back to that February analysis with a reminder that Mario can’t fight Minecraft.