From Yahoo! Finance by Lawrence Lewitinn While Fed Chair Janet Yellen and Vice Chair Stanley Fischer recently hinted that another rate hike is likely sometime by the end of the year, low interest rates may be here for the long run irrespective of Fed action.

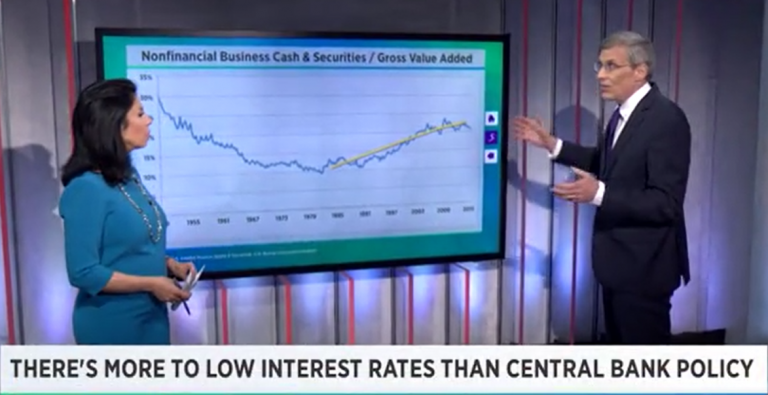

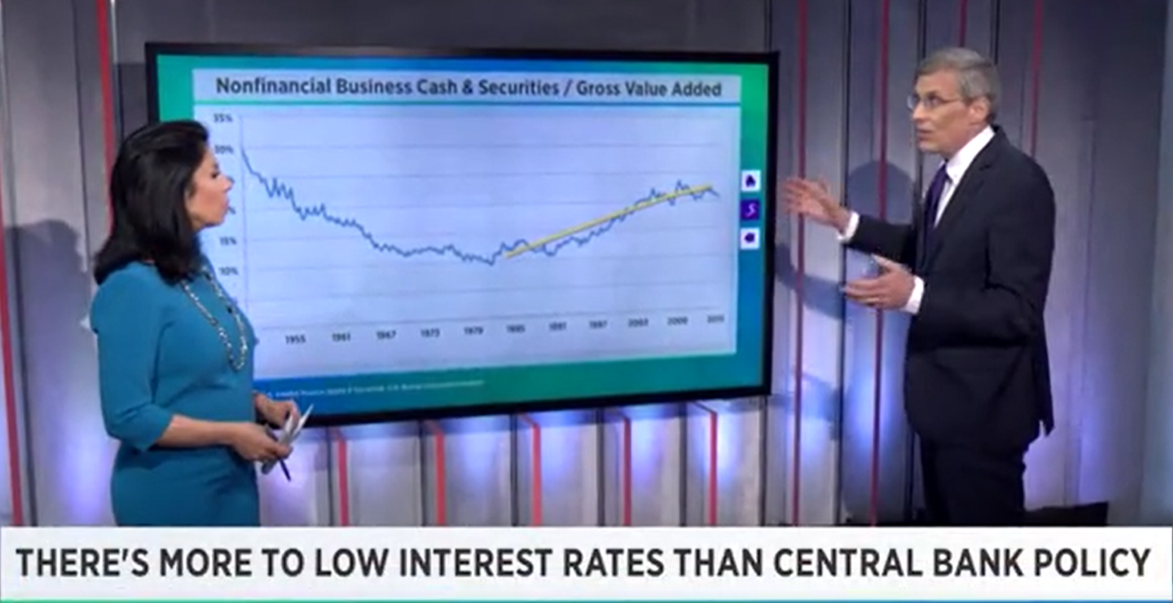

Lower rates are not just the result of central banks buying billions of dollars worth of bonds over the years in the United States, Europe, and Japan, according to Brian Barnier, head of research at ValueBridge Advisors and founder of FedDashboard.com.

Lower rates are not just the result of central banks buying billions of dollars worth of bonds over the years in the United States, Europe, and Japan, according to Brian Barnier, head of research at ValueBridge Advisors and founder of FedDashboard.com.

For the rest of the story, charts and video visit http://finance.yahoo.com/news/why-rates-could-stay-low-000000369.html

Here at Fed Dashboard & Fundamentals discover related insights…

- Historically high corporate bond rates relative to the Federal Funds rate mean that when the Federal Open Market Committee (FOMC) hikes the Federal Funds rate, either corporate bond rates won’t move much because they are already priced at the “new normal” or those companies will get slammed with higher rates. Because the FOMC members don’t seem to understand that relative rates are already historically high, either outcome will surprise them – causing more debate thus more volatility. For more see https://feddashboard.com/smarter-bond-strategies-revealed-in-secrets-of-credit-spreads .

- Lower cost of production, not just business fear of economic risk or government policy, or excessive cost cutting are a reason why fewer funds are needed and the natural (or neutral) rate of interest is lower. While fear might turn around, lower product costs are decades-long trends in improved technology, management technique and global trade. These lower product costs are missed by advocates of “secular stagnation.” For more on why we are not in “secular stagnation,” see https://feddashboard.com/its-not-secular-stagnation-its-the-tech-and-trade-transformation .