Editor’s note: this is a summary of commentary at CNBC. Pictures and more at http://cnb.cx/1mdXxkt

Cause matters

- Confusion results when “deflation” as a word is used loosely. What matters is the cause of price changes. Is it “deflation” in the strict sense — money and central bank rates? Falling amounts purchased? Rising taxes cutting purchases? Falling costs of production? Excess liquidity searching globally for yield? Smarter shoppers searching for lower prices? Other?

- “Deflationary mindset” is not bad when consumers are buying more – it’s good.

Purchases have been growing

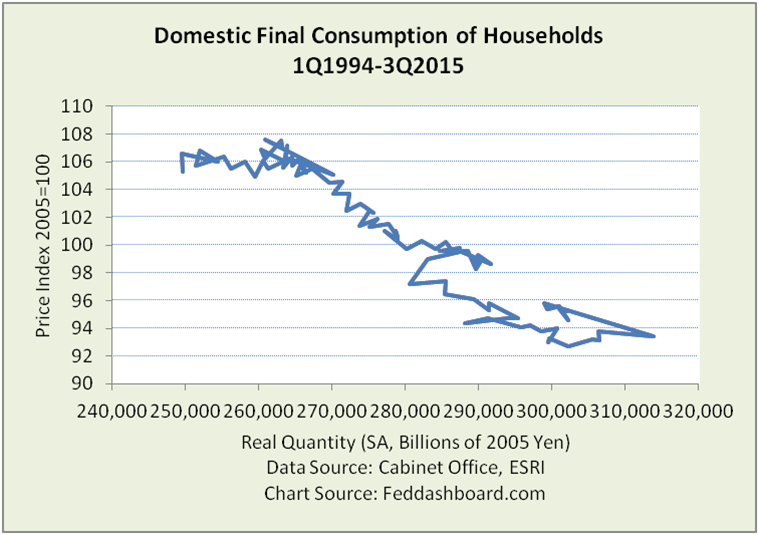

- Over the past 20 years, purchases have been growing with falling prices. Two big exceptions are the 2008 crash, and introduction of QE and consumption tax (the “fishhook”).

- Saying “deflation is problematic because of implications for demand” has not been true for over 20 years. This is pictured when the price-quantity time-track turned downward-sloping.

Power trends – PIPE Factors

- For decades, PIPE Factors (especially pacts for trade and exponential technology) have decreased price levels, and increased production and purchases.

- Technology and innovation powered “Japan Inc.”

- Japan Inc.’s explosion of better products and lower costs (especially consumer durables) meant lower prices and purchase growth.

- Two decades of “much more for less” leads to what is negatively termed “deflationary mindset.” Again, the flip to a downward-sloping price-quantity time-track.

- Not unique to Japan — more advanced in Japan. Happened in all industrial countries to varying degrees, next closest is U.S. as seen in this data animation https://feddashboard.com/no-fear-of-deflation-if-cause-is-pipe-factors. See also Europe section of Fed Dashboard & Fundamentals.

Natural interest rates

- Natural interest rates have probably fallen in Japan – not because of low demand.

- Rather, mostly because of lower costs of production (that’s good) and cash piles (including cash stashed by Japanese in dresser drawers and overseas banks).

- This is the “cash gearbox” effect.

CAUTION: BoJ’s attempt to fight technology both: hurts consumer purchases (as seen in the “fishhook”) and efforts of other ministries to regain “Japan Inc.” strength.